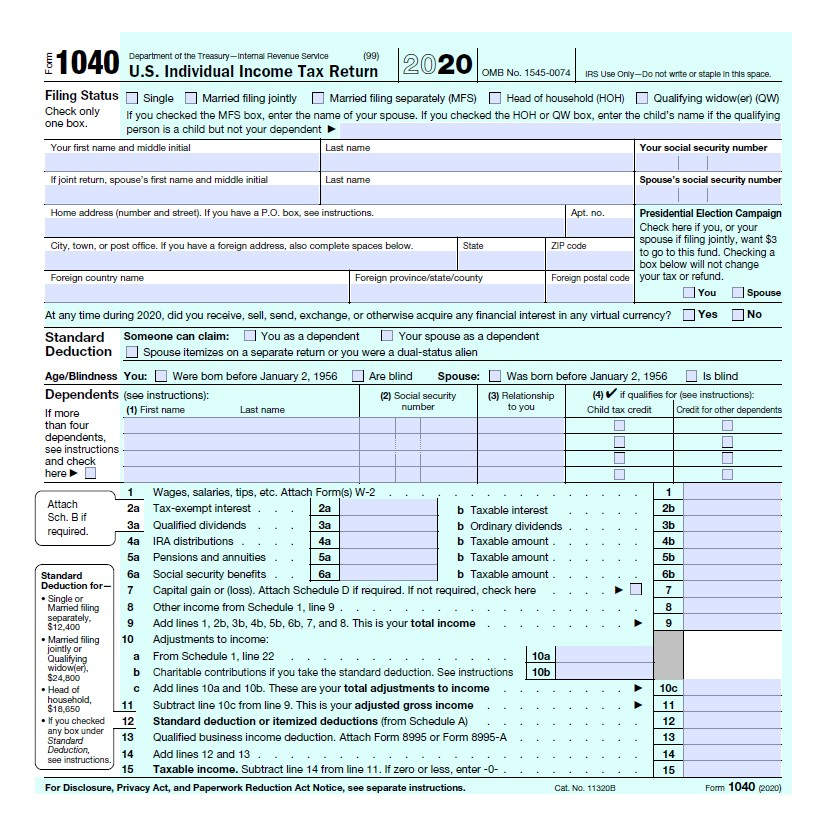

Recovery Rebate 2023 – The Recovery Rebate offers taxpayers the possibility of receiving an income tax return, without having their tax returns adjusted. The program is managed by the IRS and is a free service. When you are filing, however, it is crucial to be acquainted of the regulations and guidelines of this program. Here are some information about this program.

Recovery Rebate funds are not subject to adjustment.

Taxpayers who are eligible for Recovery Rebate credits will be informed in advance. That means your tax refund won’t be affected if you owe more taxes in 2020 as compared to 2019. Your income will influence the amount of your rebate credit. Your credit score will drop to zero for those who earn more than $75,000. Joint filers with spouses will see their credit drop to $150,000 and heads of household will begin to see their recovery rebate refunds decreased to $112,500.

If they did not get all of the stimulus money however, they are still eligible for tax relief credits for 2020. To be eligible, they must have an online account with the IRS and also a paper notice listing the total amount that was distributed to them.

It does not provide an opportunity to receive a tax refund.

Although the Recovery Rebate does NOT provide a tax return for you but it does give tax credits. IRS has cautioned people about the mistakes they made in applying for this stimulus cash. There have been mistakes committed in the field of child tax credits. The IRS will send you a letter in the event that the credit isn’t applied correctly.

The Recovery Rebate is available for federal income tax returns through 2021. You can get up to $1,400 for each qualifying tax dependent (married couples with two children) and up to $4200 for single filers.

It can be delayed by mathematical errors or mistakes

If you are sent an email from the IRS stating that there was an error in the math on your tax returns, you should take some time to check and rectify it. Your refund could be delayed if you submit inaccurate information. There are answers to your questions within the vast FAQ section on IRS.

There are a variety of reasons why your recovery rebate could be delayed. Most often, the reason behind delays is a miscalculation in claiming tax credits or stimulus funds. The IRS warns taxpayers to double-check tax returns and ensure they correctly claim each stimulus money.