Rebate Recovery Credit 2023 Form – The Recovery Rebate allows taxpayers to get a tax refund without having to adjust the tax return. The IRS manages the program that is a no-cost service. It is essential to familiarize yourself with the regulations before applying. Here are some of the facts you need to know about the program.

Recovery Rebate reimbursements don’t have to be adjusted.

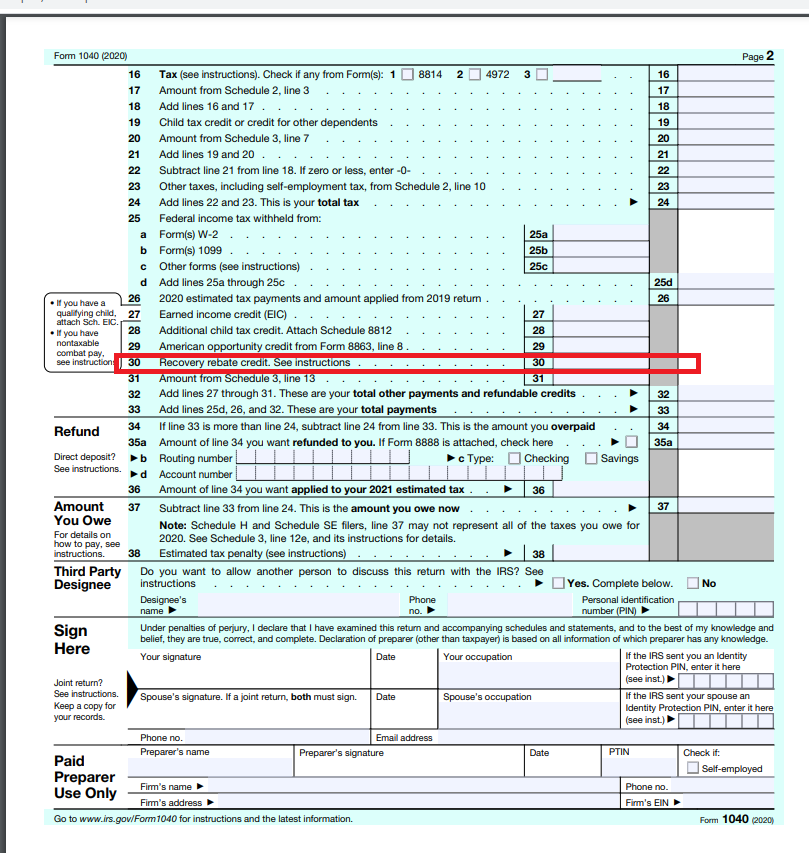

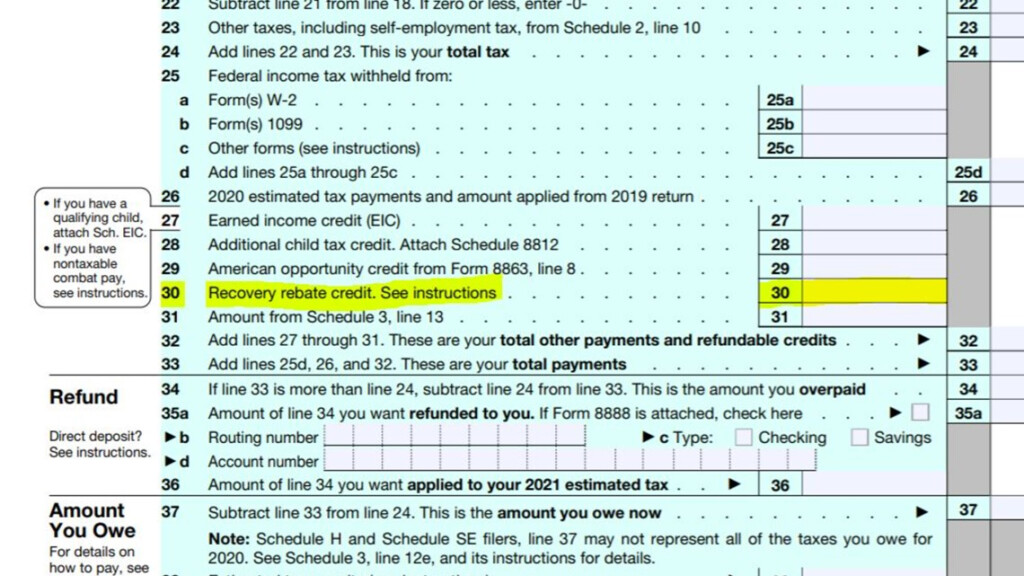

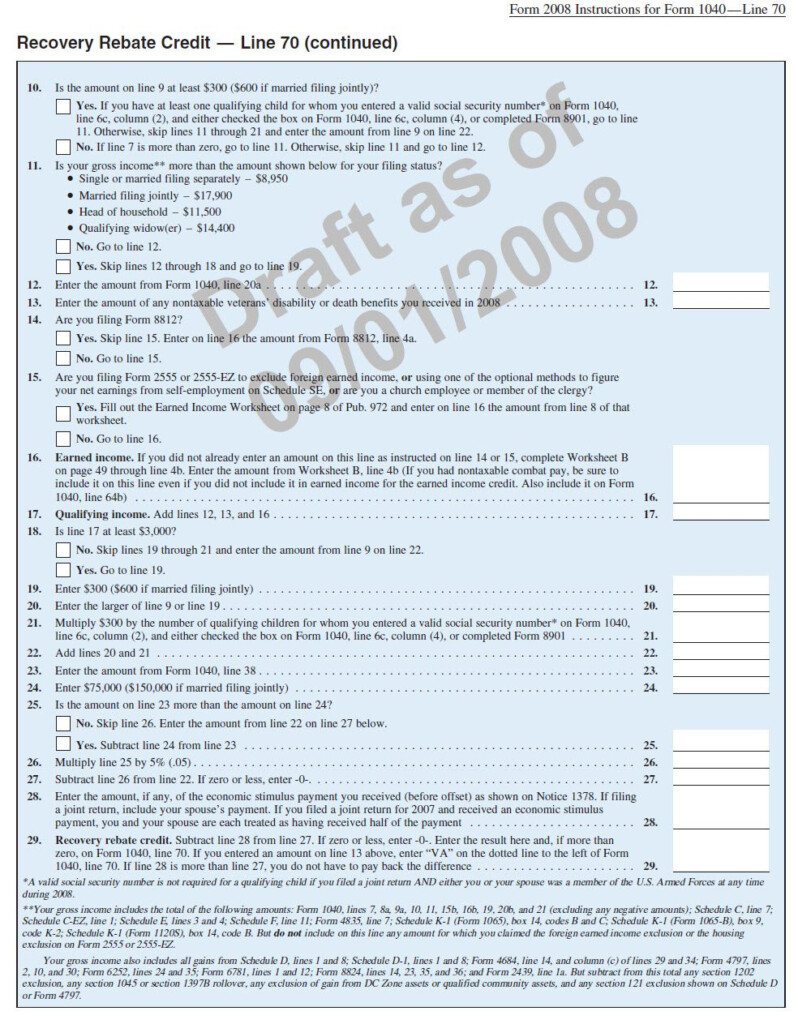

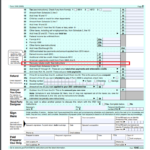

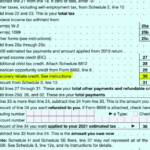

Taxpayers who qualify will be eligible to receive the credit for Recovery Rebate prior to. You don’t have to adjust your refund if the tax bill is more than that of 2019. However your rebate for recovery will be diminished depending on your income. Your credit rating could drop to zero If you earn more that $75,000. Joint filers who file jointly with their spouse will see their credit starting to decline to $150,000. Heads of household will start to see their reimbursement refunds drop to $112,500.

People who have not received all of the stimulus funds in 2020 are still eligible to receive reimbursement rebate credits. To qualify for this tax credit you must open an online IRS account and supply a copy of the amount that was given to them.

It doesn’t offer a refund of tax

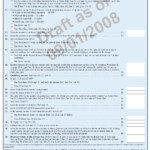

Although the Recovery Rebate will not give you a return on your tax bill, it will grant taxpayers with tax credits. IRS has warned people about possible mistakes in claiming this stimulus cash. There have been mistakes committed in the field of child tax credits. The IRS will send you a letter in the event that the credit isn’t applied correctly.

In 2021, Federal income tax returns are eligible to receive the Recovery Rebate. A qualified tax dependent could receive up to $1,400 (married couples having two children) or $4200 (single taxpayers).

It is also delayed due to math mistakes and incorrect calculations.

You should double-check your information and make any adjustments if you get a letter from IRS notifying you of an error in math on the tax return. Incorrect information can result in your tax refund being delayed. The IRS has a wealth of FAQs to help you answer any questions.

There are several reasons why your recovery refund could be delayed. The most frequent reason is the mistake made when claiming stimulus money or the child tax credit. The IRS advises taxpayers to double-check their tax returns and ensure they correctly claim each stimulus payment.