Rebate Recovery Act – The Recovery Rebate allows taxpayers to get a tax refund without the need to alter the tax return. This program is run by the IRS. It’s completely cost-free. Prior to filing, however, it is crucial to be acquainted of the regulations and guidelines of the program. These are the essential points you need to be aware of about the program.

Refunds received from Recovery Rebate do not have to be adjusted

Recovery Rebate credits are distributed to taxpaying taxpayers who are eligible in advance. If you owe more tax in 2020 than in the year prior to it, your refund will not be adjusted. In accordance with your earnings, however the recovery credit might be reduced. Your credit score could drop to zero if your income exceeds $75,000. Joint filers who have spouses will be able to see their credit begin to decline at $150,000. Household members and heads will notice that their recoveries rebates beginning to drop to $112,500.

While they may not have received the entire stimulus amount People can still claim refund rebate credits towards their tax obligations in 2020. In order to do this, they must have an account online with the IRS and a physical notice listing the total amount that was distributed to them.

It does not offer a tax refund

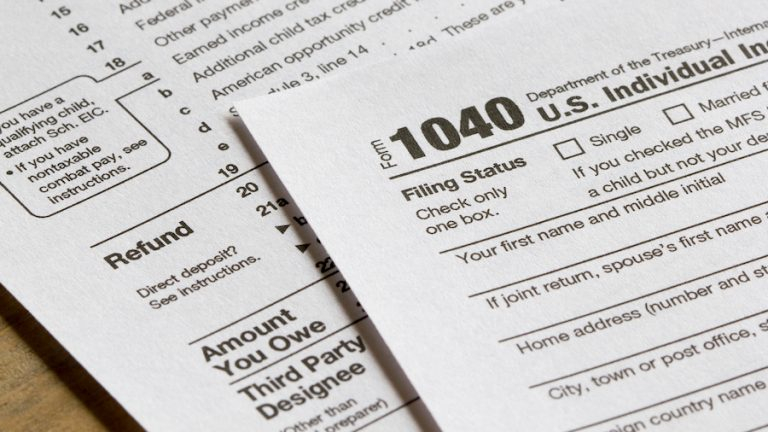

Although the Recovery Rebate doesn’t provide you with tax returns, it does provide you a tax credit. IRS has issued a warning about mistakes made in claiming this stimulus cash. The tax credit for children is another area where errors were made. The IRS will issue a notice if the credit is not applied properly.

For 2021 Federal income tax returns will be eligible for the Recovery Rebate. Each tax dependent is qualified for as much as $1400 (married couples with 2 children) or up to $4200 (single taxpayers).

It is also delayed due to math mistakes and miscalculations

If you get a letter from the IRS that says there is a math error on your tax return, you should spend a few minutes to review your tax return and make any adjustments that are required. Incorrect information could result in your tax refund being delayed. There are answers to your questions in the comprehensive FAQ section on IRS.

There are many reasons that your recovery rebate might not be processed in time. The most common cause for delay is a miscalculation in filing a tax credits or stimulus funds. The IRS has advised taxpayers to double check their tax returns as well as be sure they’re declaring each stimulus payment.