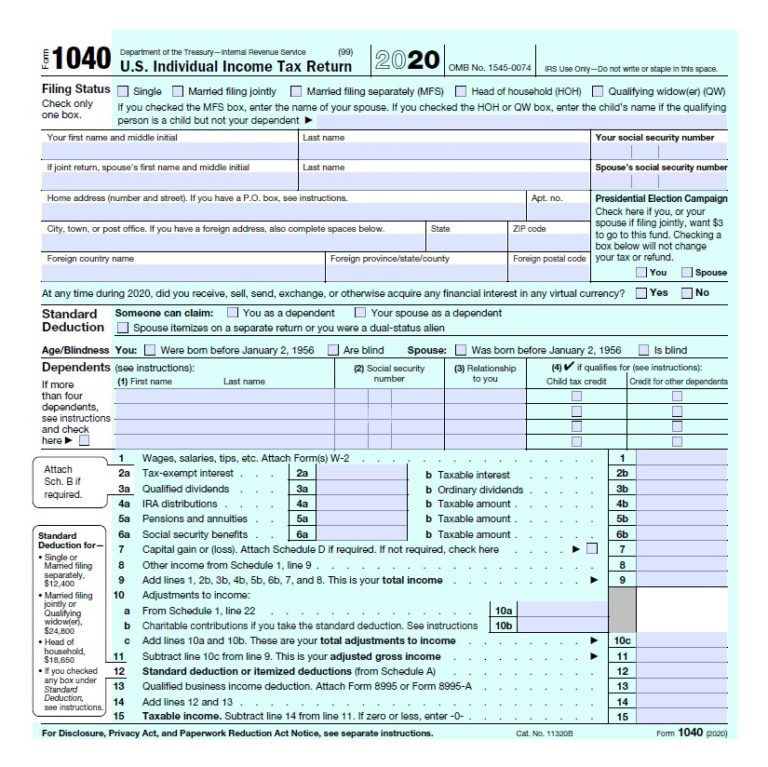

Rebate Recovery – Taxpayers can receive a tax rebate through the Recovery Rebate program. This permits them to get a refund on their taxes without the need to amend their tax returns. This program is administered by the IRS and is a no-cost service. Prior to filing however, it’s essential to be familiar with the regulations and rules of the program. Here are some things to learn about this program.

Refunds received from Recovery Rebate do not have to be adjusted

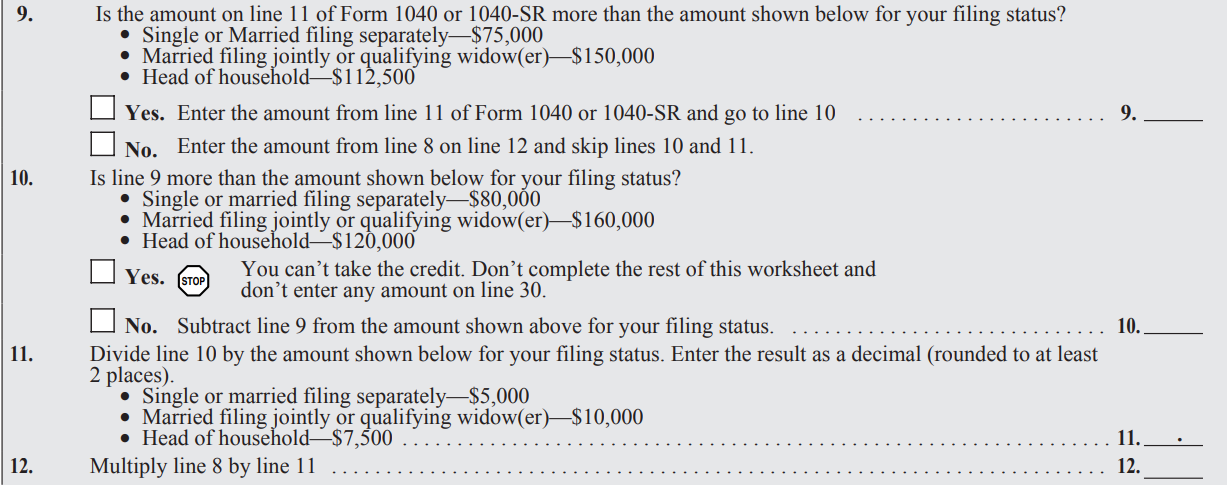

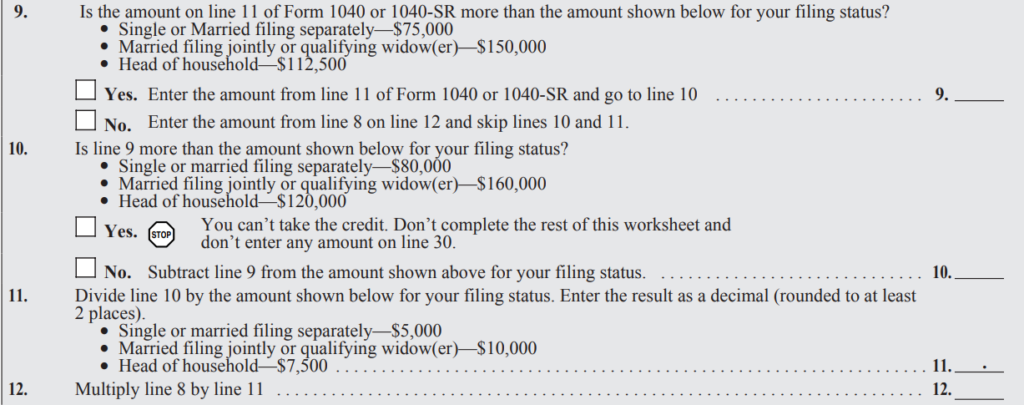

Taxpayers eligible to receive Recovery Rebate credits are notified prior to. This means that your refund won’t be affected if you are owed more tax in 2020 compared to the year prior. In accordance with your earnings, however your recovery credits could be reduced. Your credit score could drop to zero if your income exceeds $75,000. Joint filers who have a spouse will drop to $150,000. Heads of households will begin to have their reimbursements for recovery rebates reduced to $112,500.

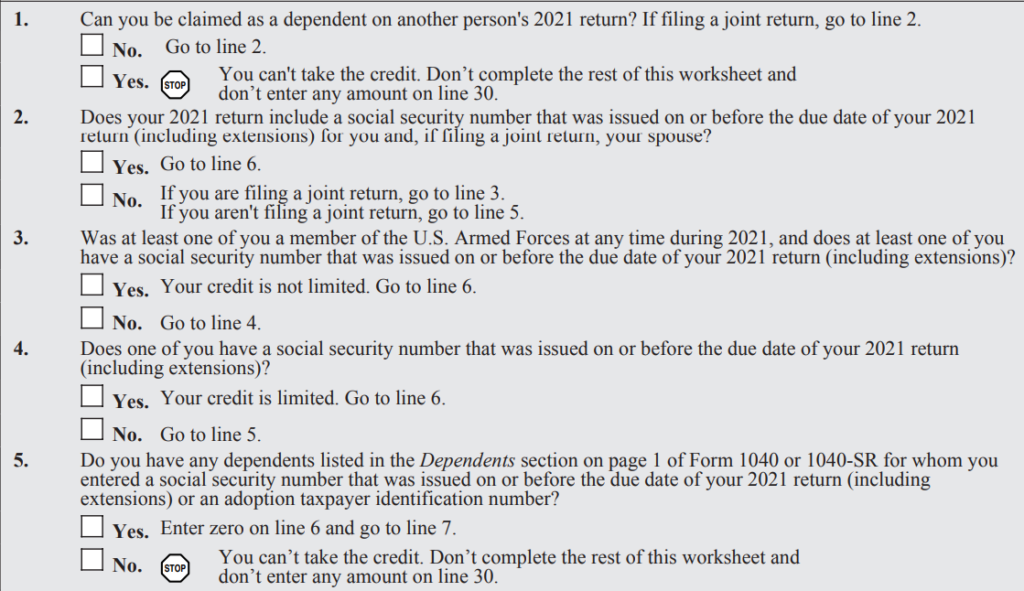

Individuals who didn’t receive full stimulus payments may still be eligible for rebate credits on their tax returns in 2020. They will need an IRS online account as well as a notice listing all the amounts they have received.

It doesn’t allow for a tax return

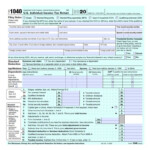

Although the Recovery Rebate will not give you a tax refund, it will give you taxes, it will give you with tax credits. IRS has warned taxpayers against doing things wrong when applying for this stimulus cash. Another area in which mistakes were made was the tax credit for children. If the credit isn’t properly applied, you will receive an official letter from IRS.

The Recovery Rebate is available for federal income tax returns through 2021. If you are married and have at two kids, you could receive up to $1,400 and for single filers , up to $4200.

It can also be delayed by math errors or miscalculations

If you get a letter informing you that the IRS has found a math mistake on your tax return, you should take a moment to double-check and adjust the information. A mistake in your information could result in a tax refund to be delayed. There are answers to your queries in the vast FAQ section on IRS.

There are several reasons why your Recovery Rebate might be delayed. The most frequent reason why that your recovery payment could delay is because you made a mistake when applying for the stimulus money and the tax credits for children. The IRS is advising taxpayers to double check their tax returns and be sure they’re declaring each stimulus payment.