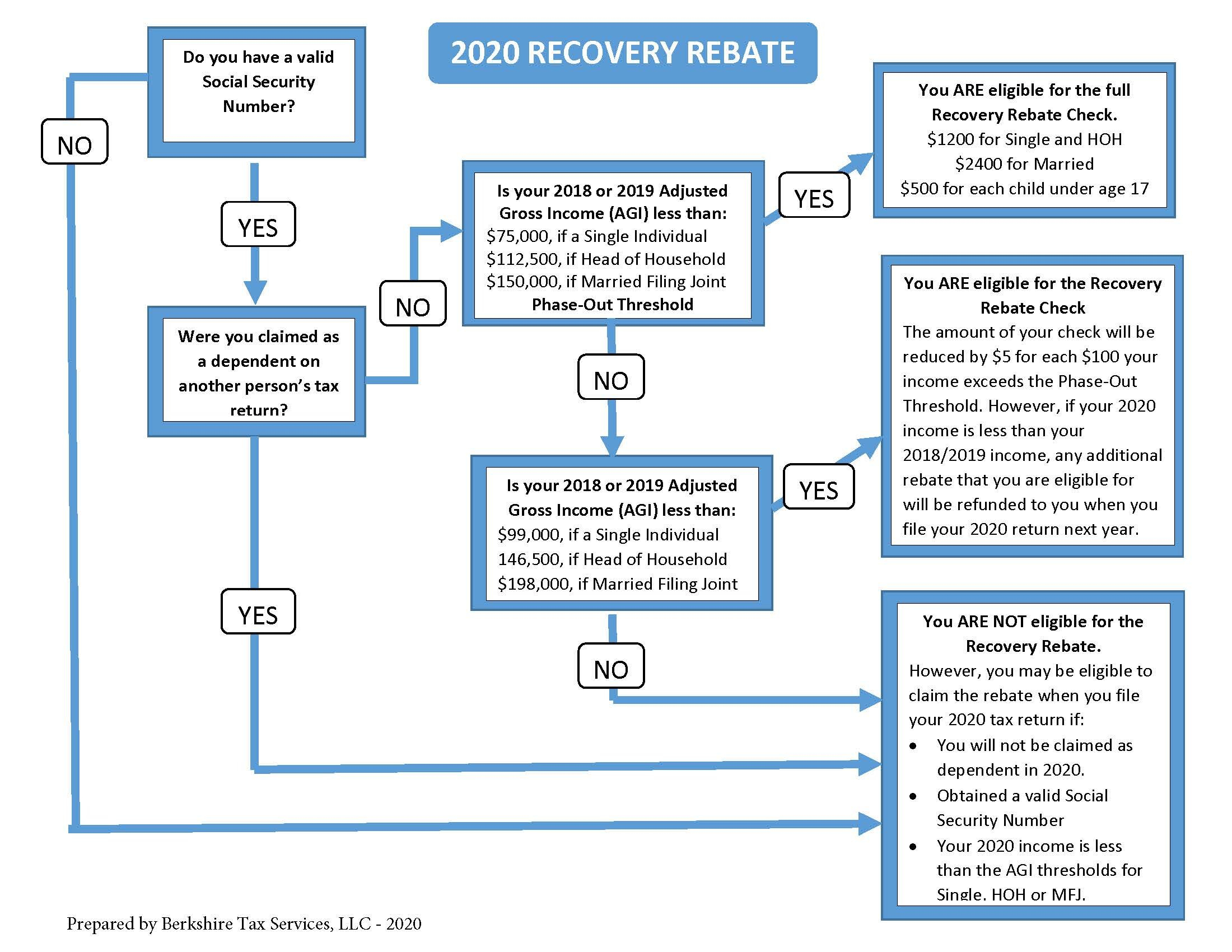

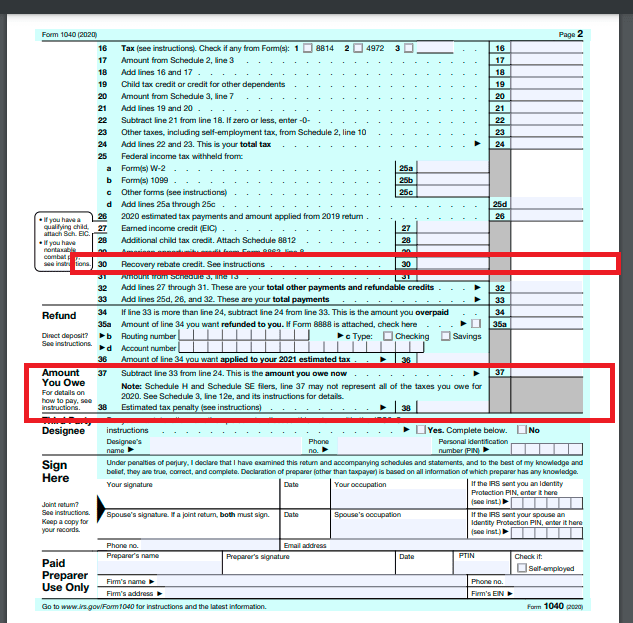

I Claimed The Recovery Rebate Credit

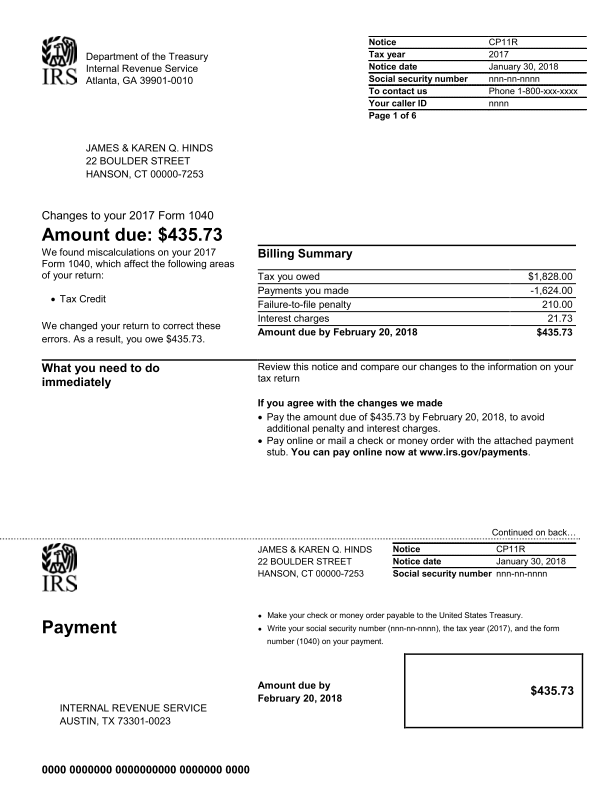

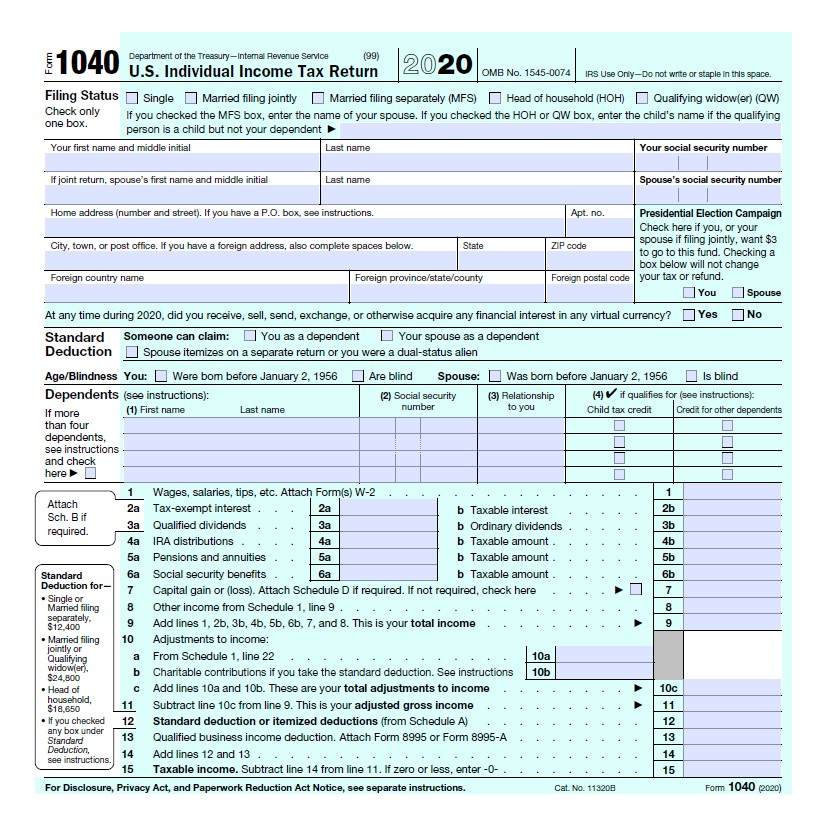

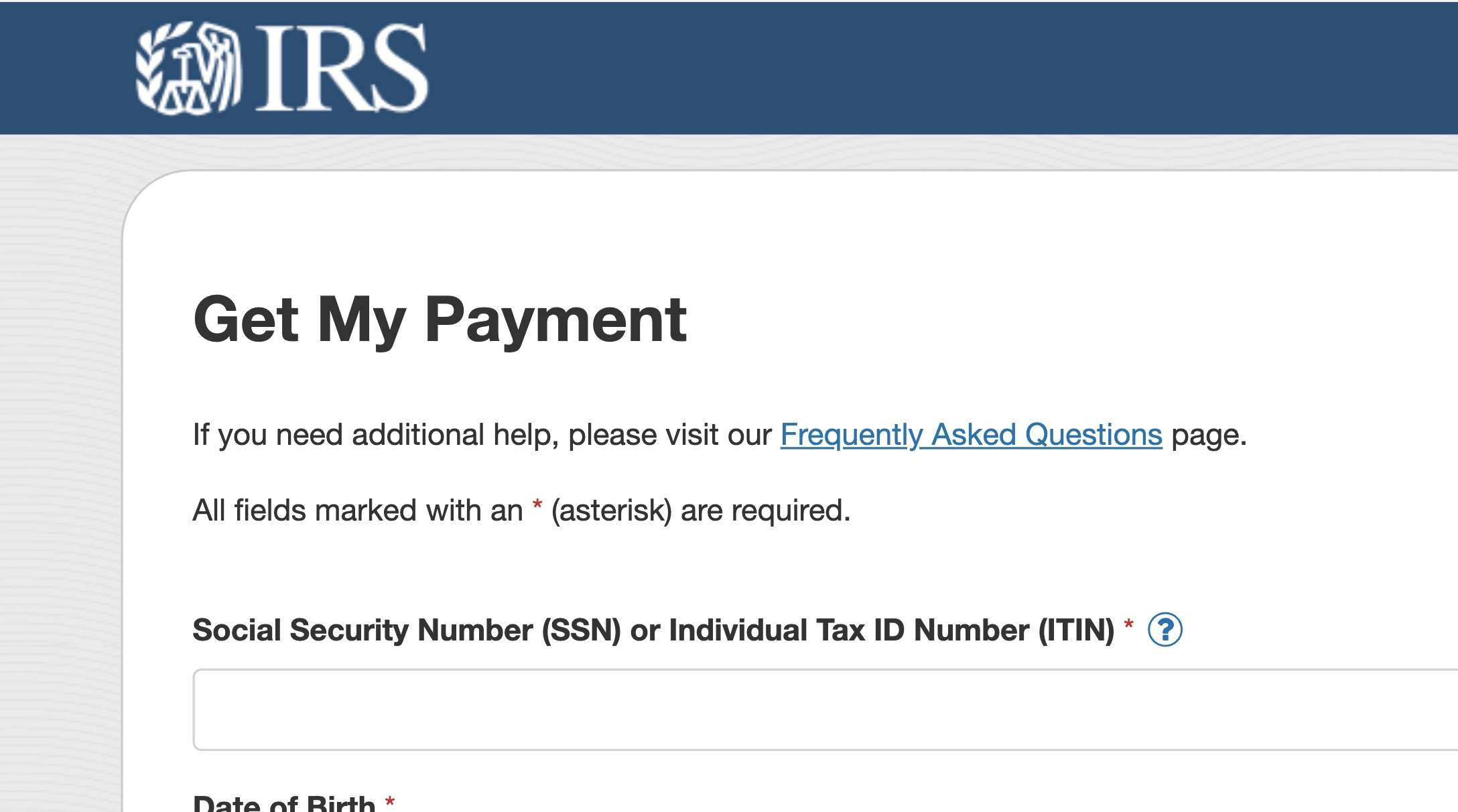

I Claimed The Recovery Rebate Credit – A Recovery Rebate is an opportunity taxpayers to claim an amount of tax refund without altering their tax returns. The program is managed by the IRS and is a completely free service. However, prior to filing, it is crucial to know the regulations and rules. These are just … Read more