Notice Cp12 Recovery Rebate Credit 2023 – The Recovery Rebate offers taxpayers the opportunity to receive a tax return with no tax return altered. The program is managed by the IRS and is a completely free service. It is crucial to know the rules and regulations of this program before you submit. These are just a few facts about this program.

Recovery Rebate refunds do not need to be adjusted

Eligible taxpayers are eligible to be eligible for Recovery Rebate credits advance. This means that should you have an amount of tax that is higher in 2020 than in the year before, you don’t be required to adjust your tax refund. However the recovery rebate credit will be diminished based on your income. If you earn more than $75k, your credits will be reduced to zero. Joint filers who file jointly with a spouse will have their credit drop to $150,000. Household heads as well as joint filers will begin to see the rebate payments decrease to $112,500.

Individuals who weren’t able to receive all of the stimulus payments may still be eligible for credits for tax refunds in 2020. They’ll require an IRS online account as well as an official notice of the amounts they have received.

It does not allow the filing of a tax return.

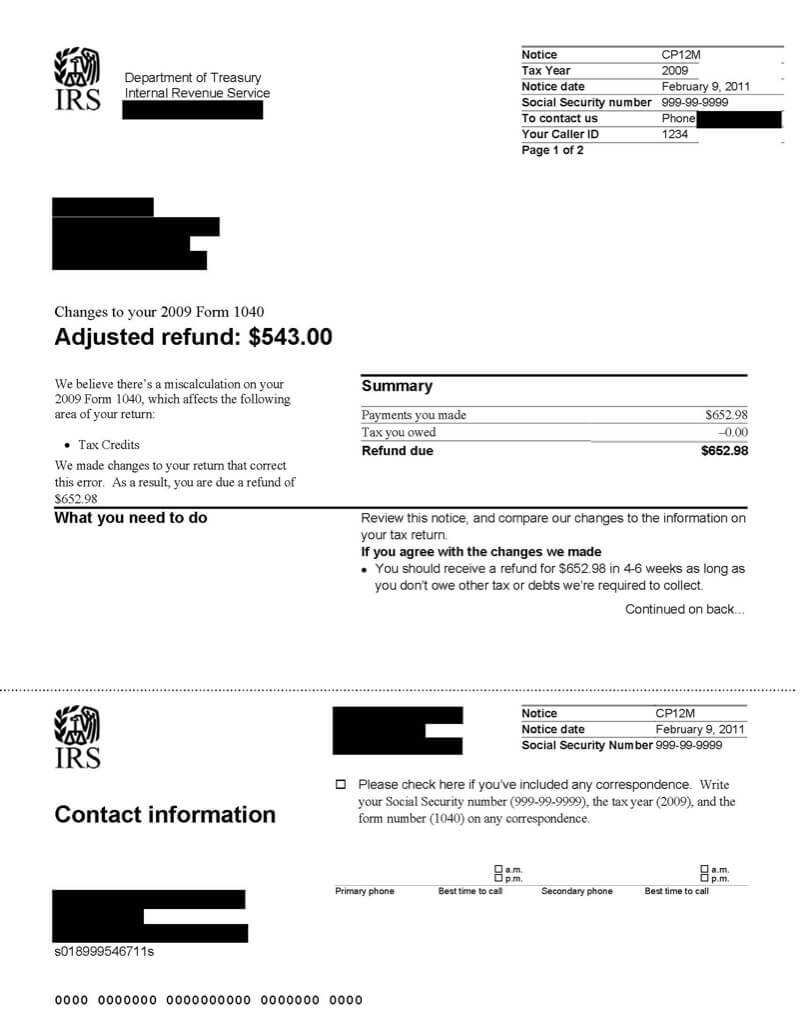

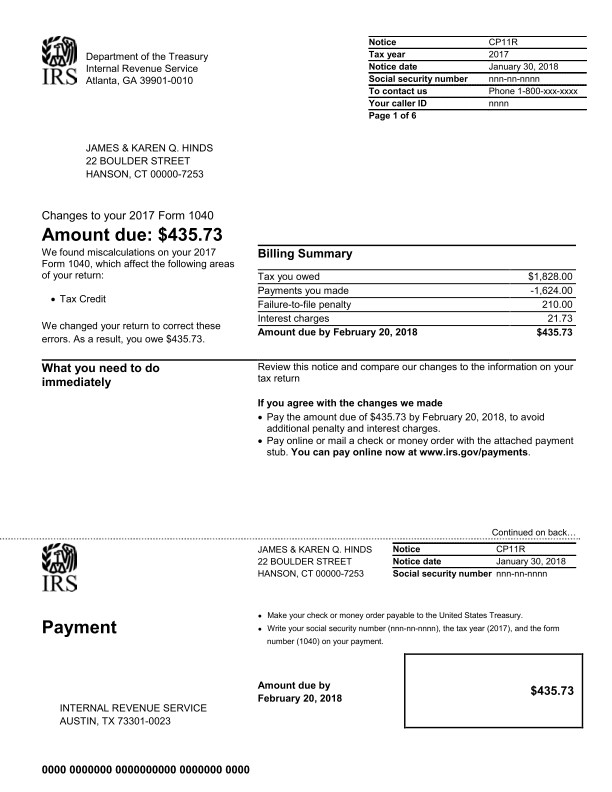

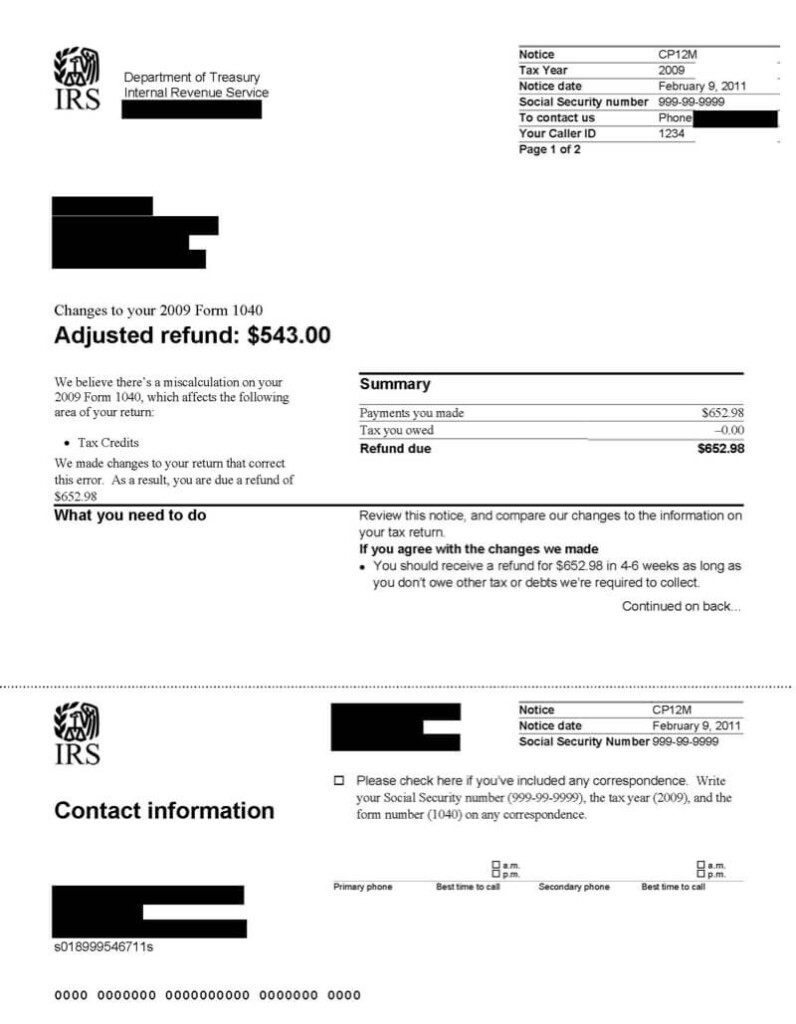

Although the Recovery Rebate doesn’t provide you with tax returns, it can provide tax credit. The IRS has issued warnings regarding errors in the process of declaring this stimulus funds. The child tax credit is another area that has been susceptible to mistakes. If you fail to apply the credit in a proper manner and correctly, the IRS might send you a letter.

The Recovery Rebate can be applied to federal income tax returns that are filed up to 2021. For married couples who have at two kids, you can receive up to $1,400 or for single filers up to $4200.

It may be delayed due to math errors or miscalculations

If you are sent a letter by the IRS informing you that there was an error in maths in your tax returns, take some time to check and correct the error. If you fail to provide correct information, your tax refund may be delayed. The IRS offers a variety of FAQs that will answer all your questions.

There are many reasons that your recovery rebate may be delayed. The most frequent reason is the mistake made when claiming stimulus funds or the child tax credit. The IRS has warned taxpayers to double-check their tax returns and ensure they declare every stimulus money correctly.