Irs Recovery Rebate Credit Worksheet 2022 – The Recovery Rebate allows taxpayers to get a tax refund, without having to adjust the tax return. This program is run by the IRS and is a completely free service. However, it is important to know the rules and regulations for the program prior to filing. Here are some details regarding this program.

Recovery Rebate Refunds are not subject to adjustment

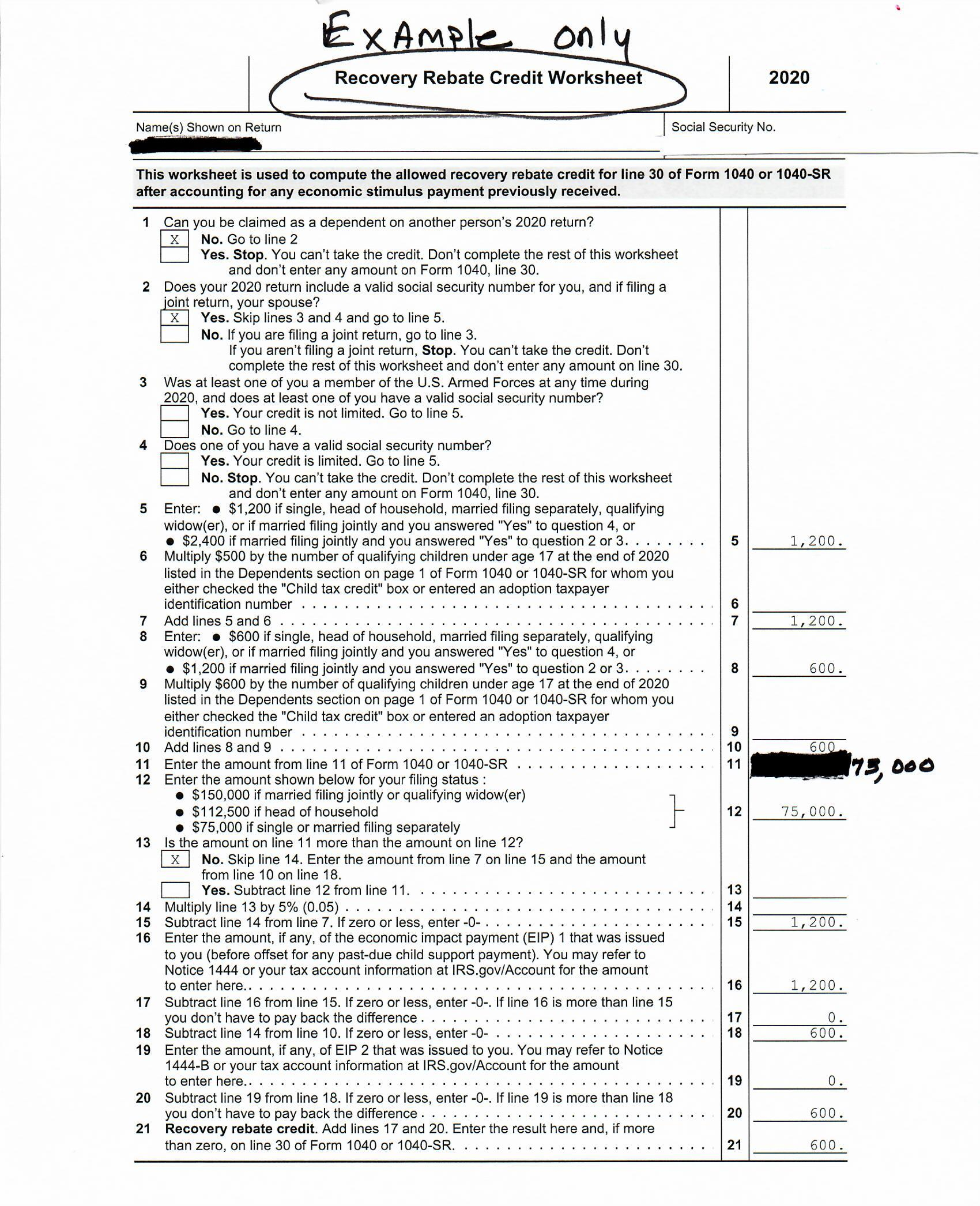

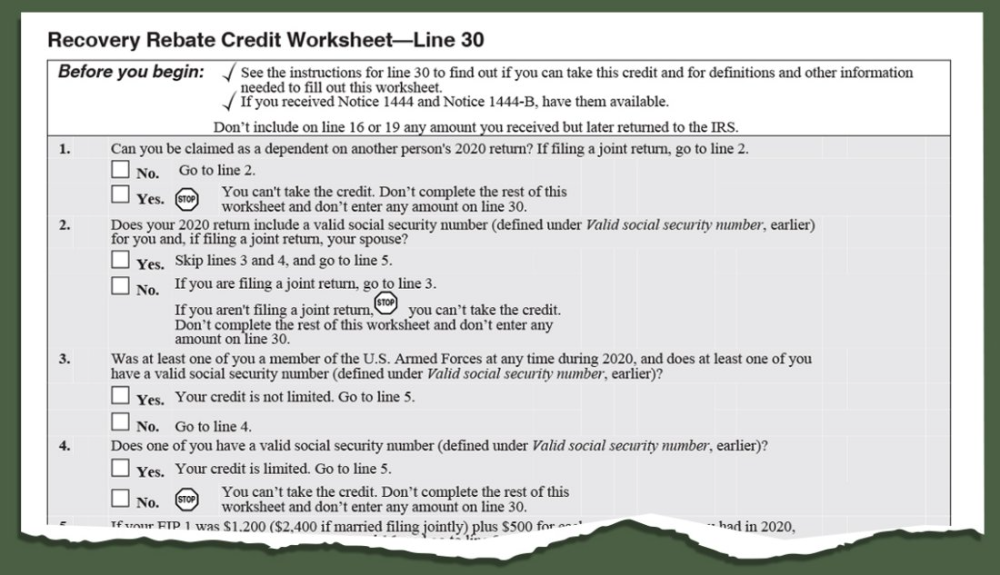

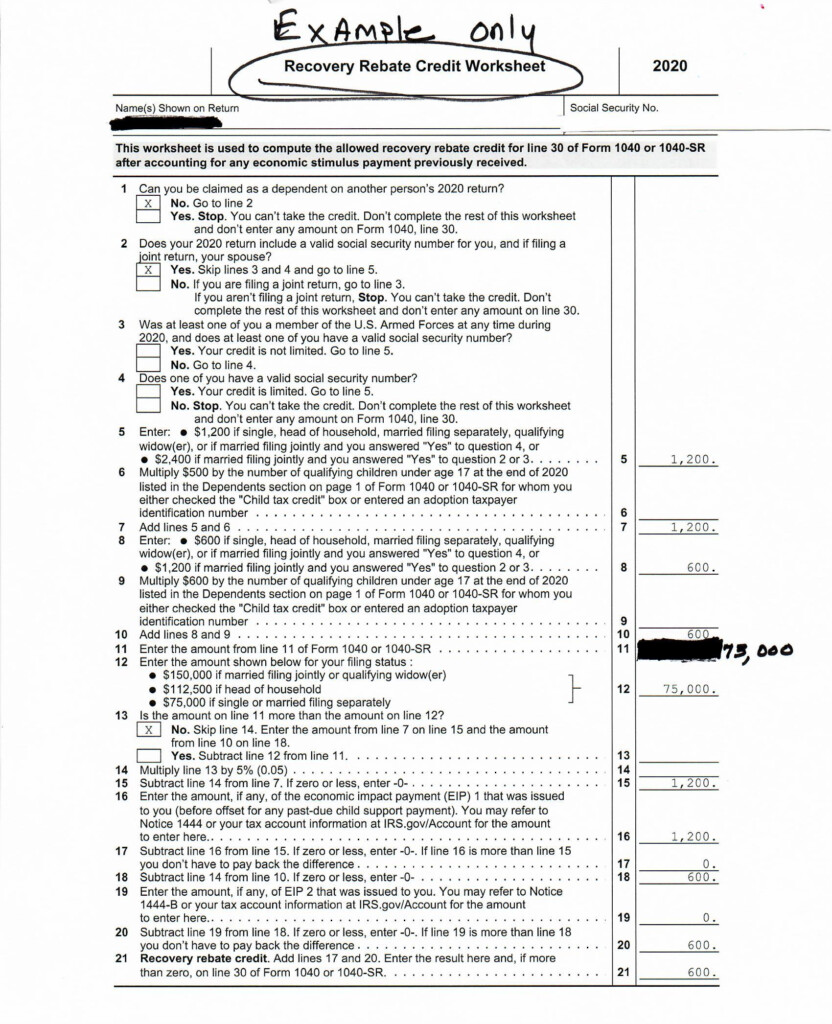

Recovery Rebate credits are given to taxpayers eligible for them in advance. There is no need to alter your refund if your tax bill is higher than your 2019 tax bill. But, based on your income, your recovery credit could be cut. If you earn over $75k, your credits will decrease to zero. Joint filers who have a spouse will see their credit drop to $150,000, while heads of household will see their recovery rebate refunds reduced to $112,500.

If they did not get all of the stimulus payments, they can still claim tax relief credits for 2020. You’ll need an IRS account online and an official printed document stating the amount you received.

It doesn’t offer the possibility of a tax refund

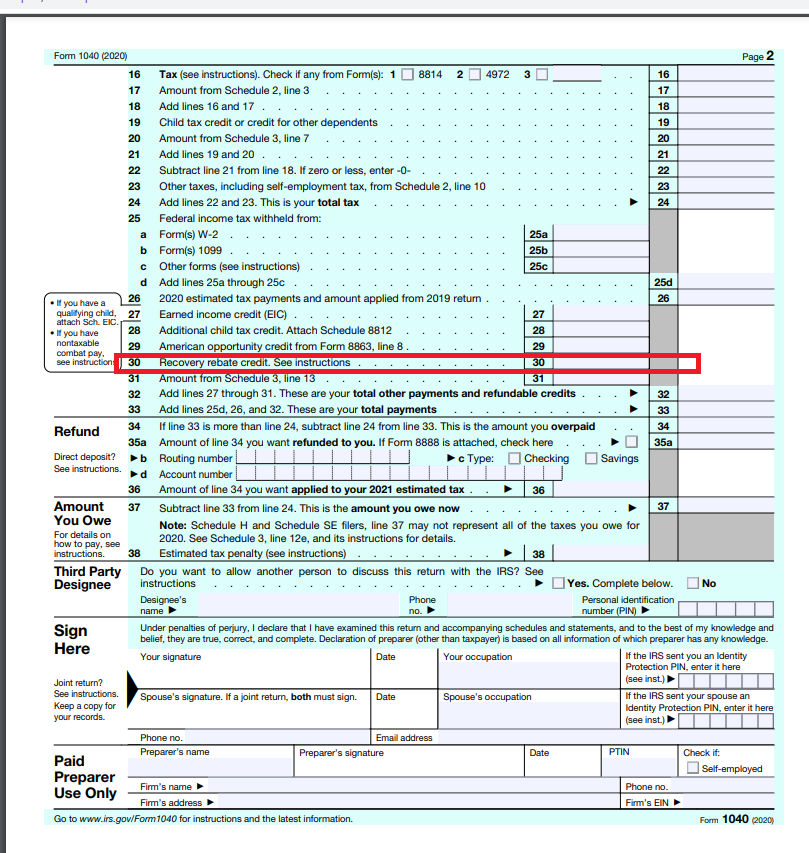

Although the Recovery Rebate will not give you a tax refund, it will give you tax bill, it will grant taxpayers with tax credits. IRS has warned people about possible mistakes in claiming this stimulus money. The IRS also committed mistakes with the application of child tax credits. In the event that the credit isn’t properly applied, you will receive an official letter from the IRS.

The Recovery Rebate is available for federal income tax returns through 2021. Each tax dependent can be qualified to receive as much as $1400 (married couples with two children) or up to $4200 (single taxpayers).

It could also be delayed by math errors or miscalculations

If you are sent an official letter from the IRS informing you that there was an error in the math on the tax return, take some time to look it up and rectify the error. The incorrect information could result in your tax refund being delayed. The IRS offers extensive FAQs to help you answer any concerns.

There are several reasons why your Recovery Rebate may be delayed. The most frequent reason why the reason your recovery refund could be delayed is because there was a mistake in applying for the stimulus money and the child tax credit. The IRS has advised taxpayers to double-check all tax returns to ensure they declare every stimulus check correctly.