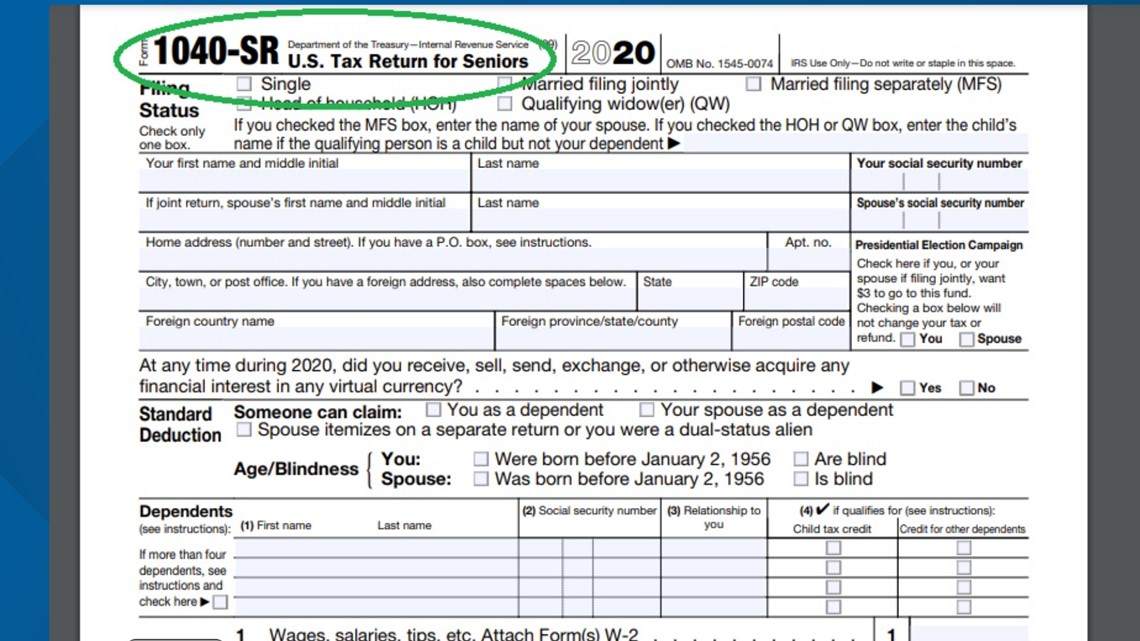

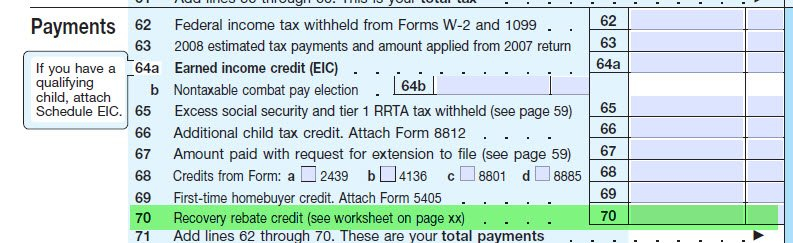

Instructions For Recovery Rebate Credit On Form 1040 – Taxpayers are eligible for an income tax credit through the Recovery Rebate program. This lets them claim a refund of taxes, without the need to amend the tax return. This program is administered by the IRS. It is crucial to understand the rules and regulations of the program before you submit. Here are some facts about this program.

Recovery Rebate refunds do not need to be adjusted

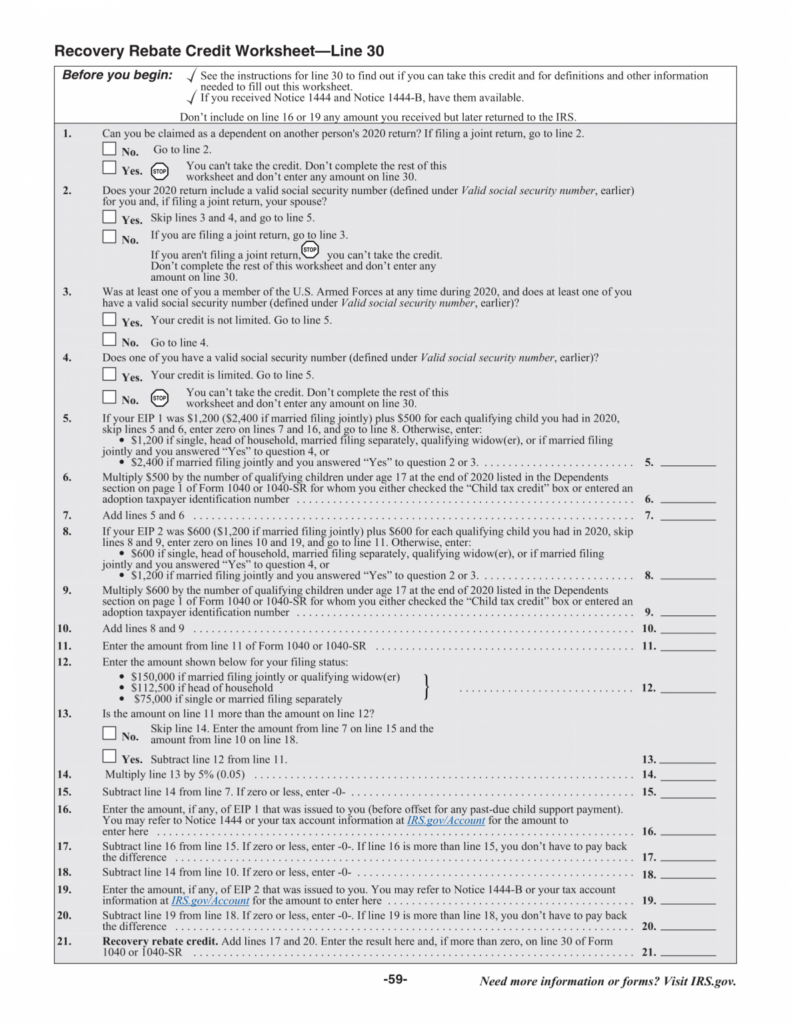

Taxpayers who are eligible for credits under the Recovery Rebate program will be notified in advance. If you owe tax more in 2020 than you did in 2019 your refund is not adjusted. Based on your income, however, your recovery credit credits could be reduced. Your credit score will drop to zero for those who make over $75,000. Joint filers will see their credit decrease to $150,000 for married couples. Heads of households are also likely to see their rebate refunds drop to $112,500.

Individuals who didn’t receive full stimulus payments could be eligible for rebate credits on their tax returns in 2020. To do this you must have an online account with the IRS as well as a printed notice listing the total amount dispersed to them.

It is not able to provide tax refunds

While the Recovery Rebate does NOT provide an income tax return to you, it does provide tax credits. IRS has issued warnings regarding mistakes made in claiming the stimulus cash. Child tax credits are another area where mistakes were made. The IRS will send a notice to you in the event that the credit has not been properly applied.

The Recovery Rebate is available for federal income tax returns through 2021. If you’re a married couple who have two children , and qualify as a tax dependent, you may get up to $1,400 or $4200 for filers who are single.

It can also be delayed due to math mistakes and incorrect calculations.

If you receive a letter from the IRS sends you a letter saying that your tax return is containing errors in math, it is important to take some time to review your data and make any corrections that are required. If you fail to give accurate information, your tax refund may be delayed. The IRS offers a wide range of FAQs to help you answer any questions.

There are many reasons your refund for the recovery program may be delayed. The most frequent reason is the mistake made when claiming stimulus funds or the tax credit for children. The IRS urges individuals to check their tax returns twice to verify that each stimulus payment is being claimed correctly.