How To Calculate Recovery Rebate Credit 2022 – The Recovery Rebate gives taxpayers an opportunity to receive an income tax refund without needing to modify their tax returns. The IRS manages this program, and it’s completely cost-free. It is crucial to understand the guidelines before applying. These are some things you should know about the program.

Refunds from Recovery Rebate do not have to be adjusted

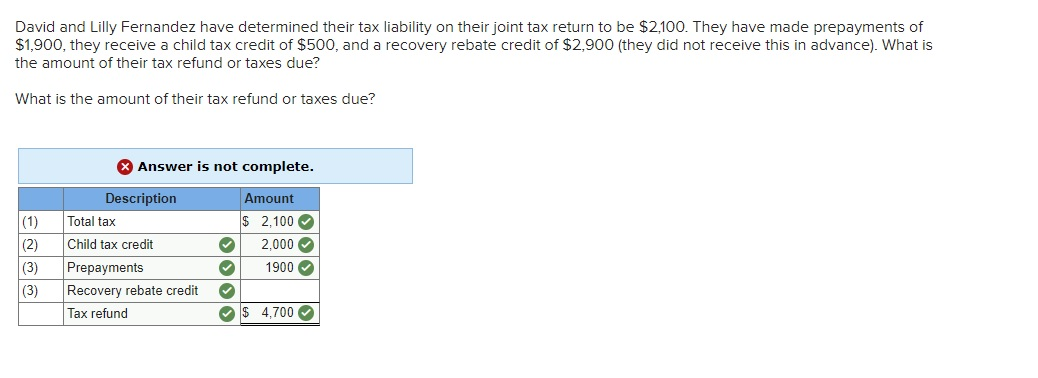

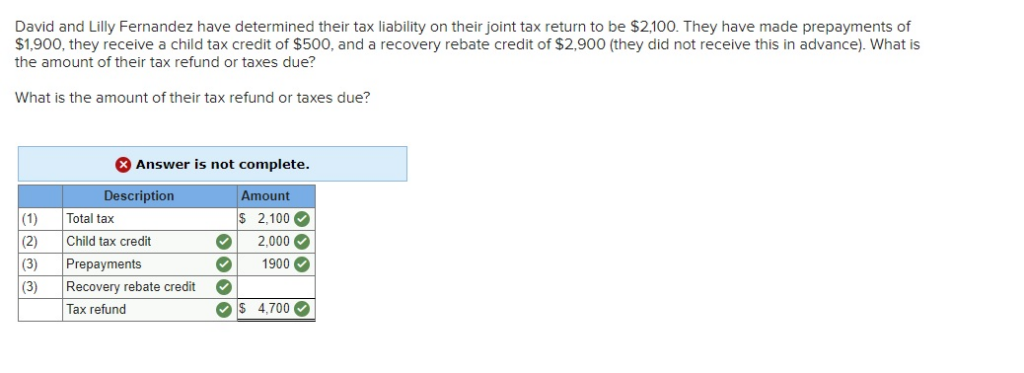

Taxpayers who are eligible for credits under the Recovery Rebate program are notified prior to. You don’t have to adjust your refund if your tax bill is higher than the 2019 one. But, based on your income, your recovery credit credit may be reduced. Your credit could be cut to zero if the amount of income you earn exceeds $75k. Joint filers and spouses will see credit start declining to $150,000. Household members and heads will begin to notice when their recovery rebate refunds begin to drop to $112,500.

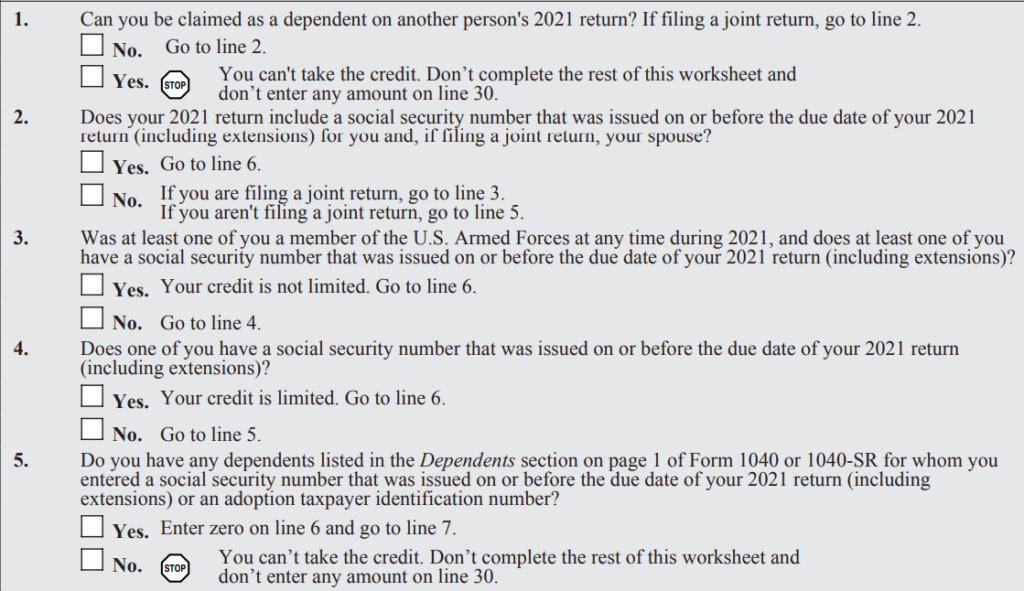

Even if they didn’t receive all of the stimulus funds however, they are still eligible for tax relief credits for 2020. They’ll require the IRS online account and an official notice of the amounts they have received.

It doesn’t provide a tax refund

While the Recovery Rebate will not give you a refund on your taxes, it will give taxpayers with tax credits. IRS has issued a warning about mistakes that are made when applying for this stimulus cash. The tax credit for children is another area where errors have been committed. If the credit is not correctly used, you’ll receive an email from IRS.

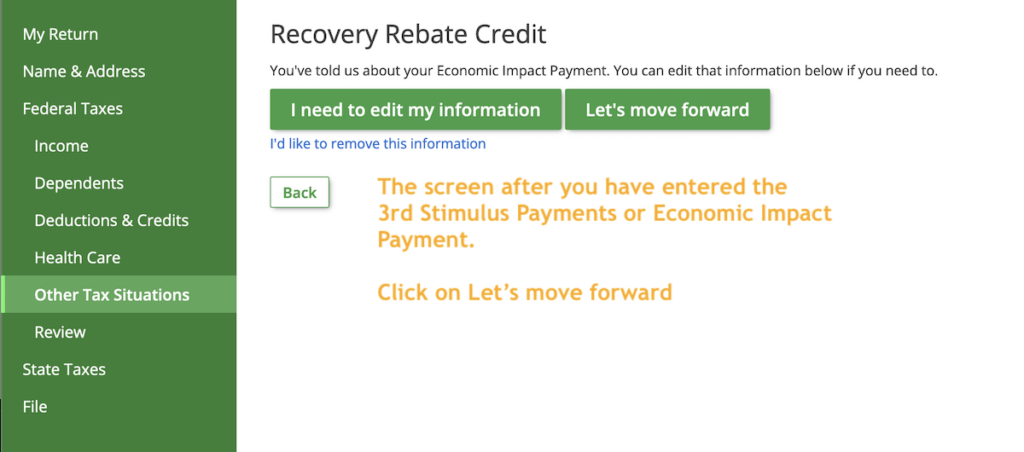

The Recovery Rebate can be applied to federal income tax returns from now to 2021. Tax dependents who qualify may receive up to $1400 (married couples having two children) or $4200 (single taxpayers).

It can also be delayed due to math mistakes or miscalculations

If you receive an official letter from the IRS informing you that there was an error in the math on your tax returns, make sure you take some time to look it up and rectify it. You may have to wait until you receive your tax refund if you provided incorrect details. The IRS offers extensive FAQs to answer your concerns.

There are a variety of reasons why your refund for the recovery program could be delayed. The most common reason is because you committed a mistake in claiming the stimulus money or child tax credit. The IRS has warned people to double-check their tax returns and ensure they claim every stimulus payment properly.