Economic Recovery Rebate – The Recovery Rebate allows taxpayers to get a tax refund, without the need to alter their tax returns. The IRS runs the program and it is a completely free service. When you are filing, however, it is essential to be familiar with the regulations and rules of the program. These are the essential points you need to be aware of about the program.

Recovery Rebate reimbursements don’t have to be adjusted.

Taxpayers eligible for credits under the Recovery Rebate program are notified prior to. You don’t have to adjust your refund if your 2020 tax bill is higher than your 2019 tax bill. However your rebate for recovery may reduce depending on your income. Your credit rating will drop to zero when you earn more than $75,000. Joint filers who file jointly with their spouse will see their credit beginning to decrease at $150,000, and heads of households will begin seeing their recovery rebate refunds drop to $112,500.

People who did not receive the full stimulus payments may still be eligible for credits for tax refunds in 2020. To do this, they must have an online account with the IRS and also a paper notice detailing the amount distributed to them.

It does not allow the filing of a tax return.

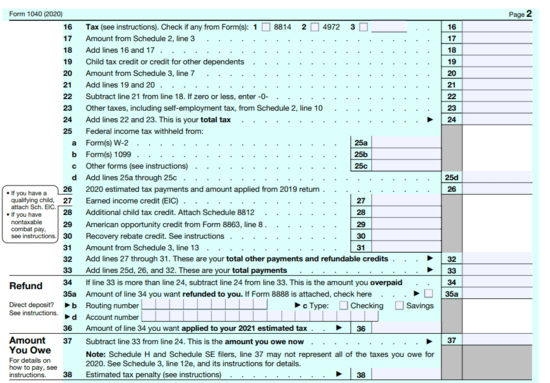

The Recovery Rebate is not a tax refund, but it gives you a tax credit. IRS has warned about potential mistakes in claiming the stimulus funds. Another area where errors have been made is the tax credit for children. If you fail to apply the credit properly and correctly, the IRS could issue a notice.

In 2021, federal tax returns for income will be eligible to receive the Recovery Rebate. If you’re married couple who have two children and count as tax dependent, you can get as much as $1,400, or $4200 for filers who are single.

It could also be delayed by math error and incorrect calculations.

If you receive a notice informing you that the IRS has found a math error on your tax return, take a moment to check and correct the information. Incorrect information could cause your refund to be delayed. There are answers to your questions within the vast FAQ section on IRS.

There are many reasons for why your rebate might not be processed in time. An error in the way you claim the child tax credit or stimulus money is among the most common reasons to delay your rebate. The IRS is advising taxpayers to double check their tax returns and ensure that they are correctly reporting each stimulus payout.