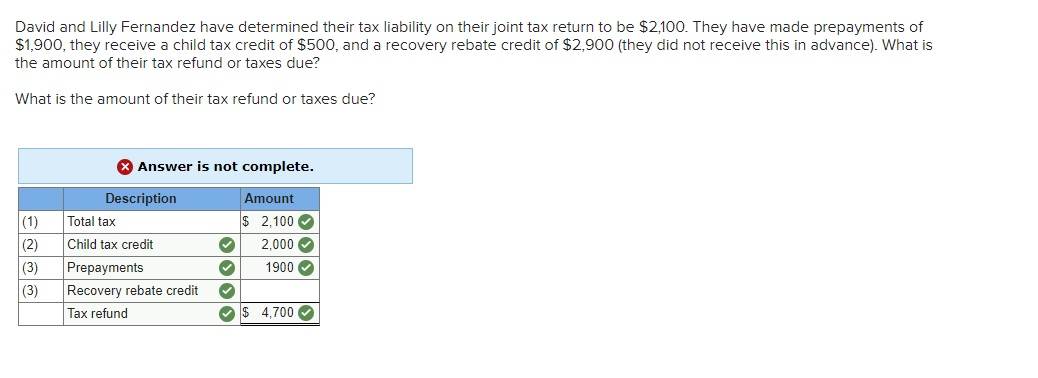

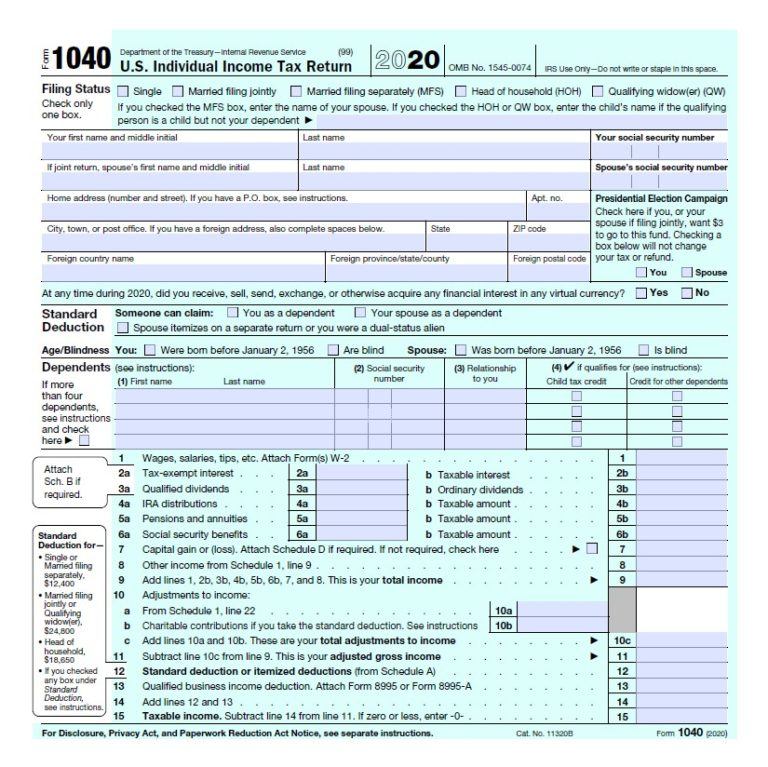

2022 Federal Recovery Rebate Credit

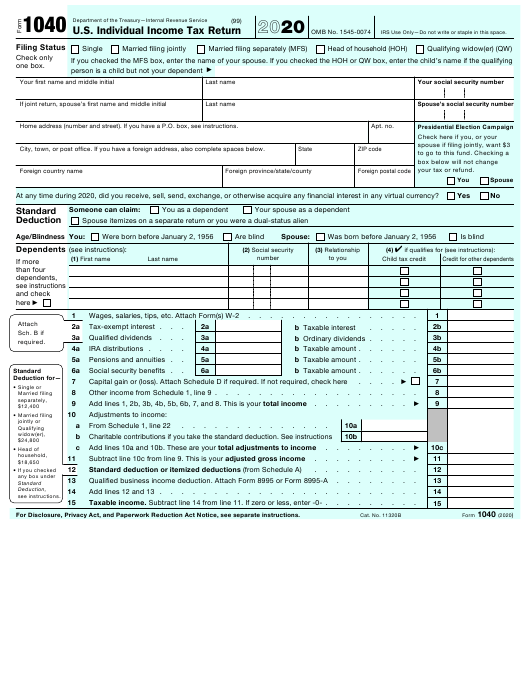

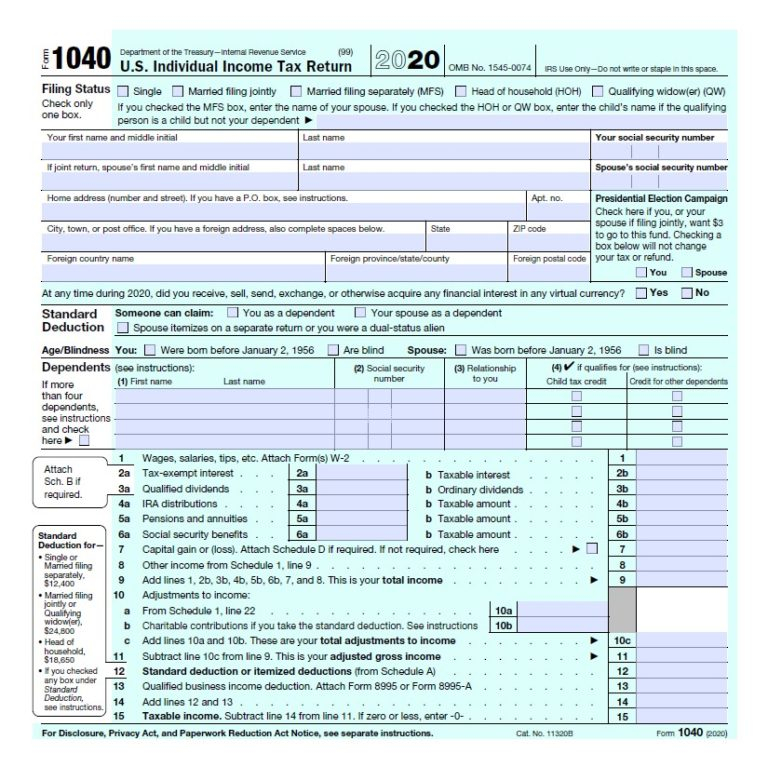

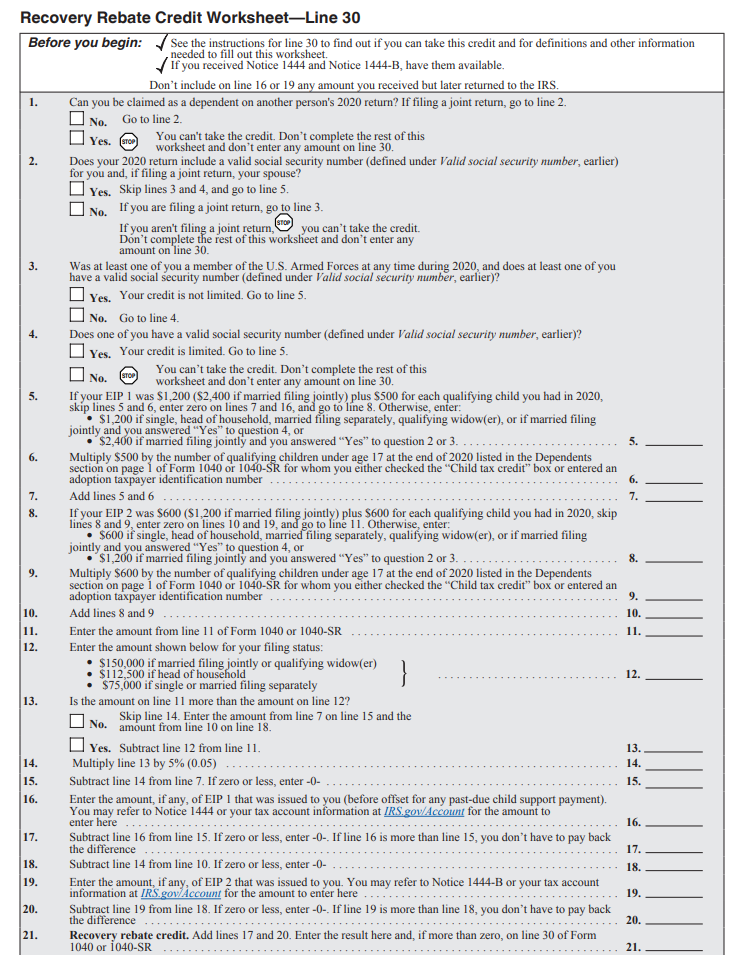

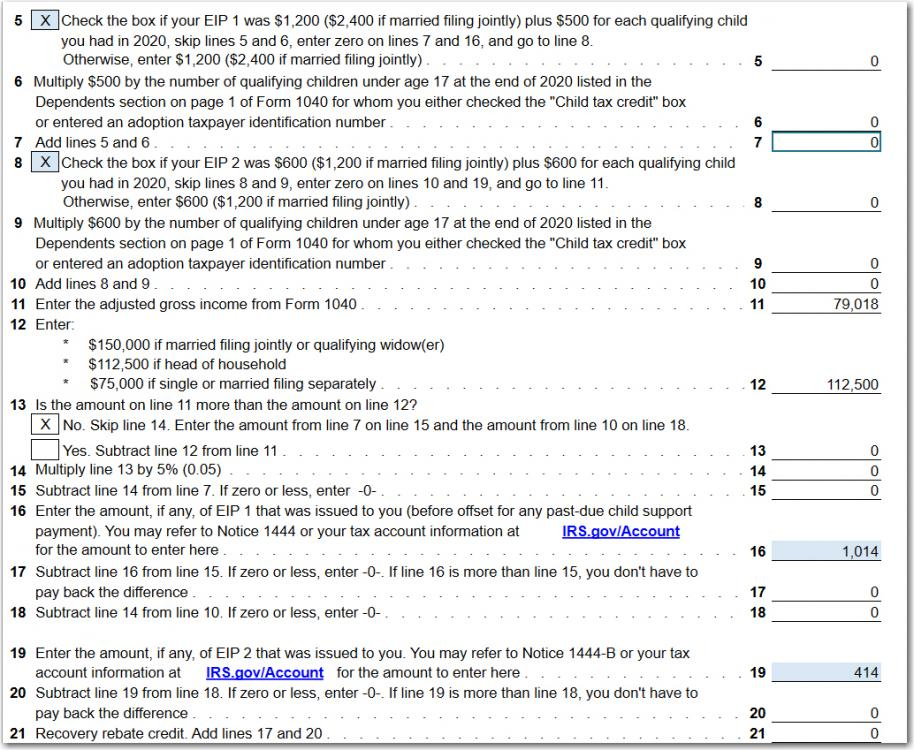

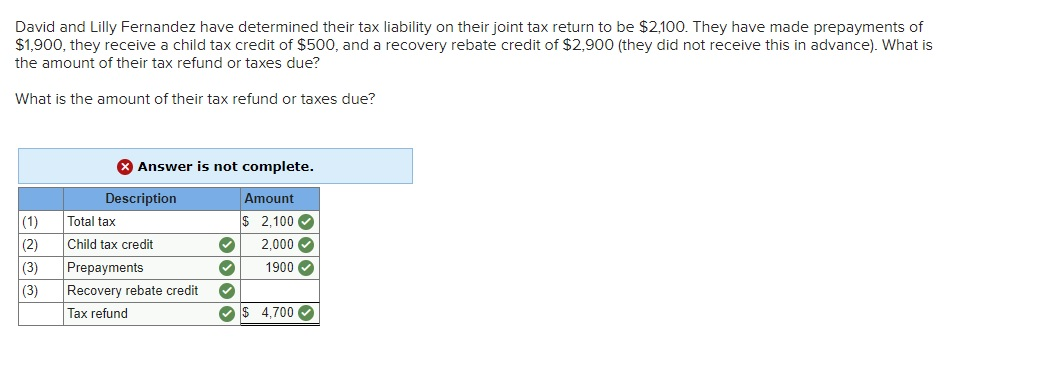

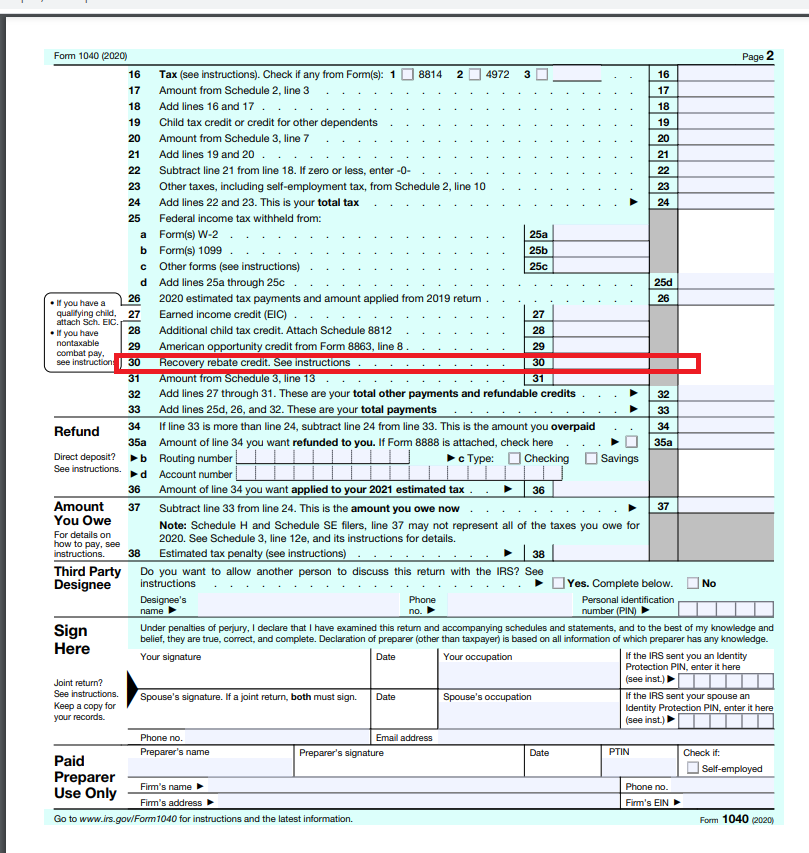

2022 Federal Recovery Rebate Credit – The Recovery Rebate allows taxpayers to receive a tax refund without having to modify the tax return. This program is run by the IRS and is a no-cost service. Before you file, however, it is essential to be familiar of the regulations and guidelines of this program. Here are … Read more