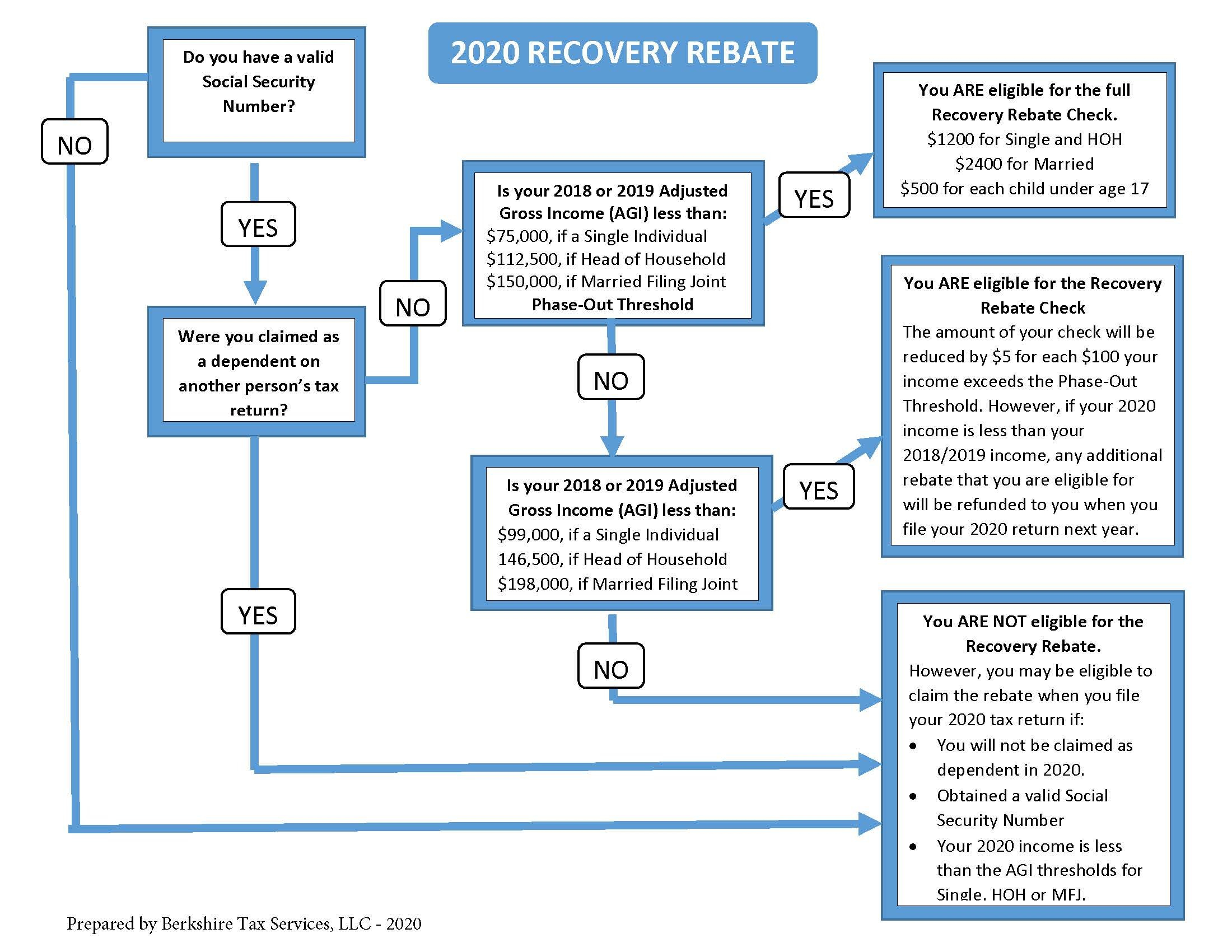

Incorrect Recovery Rebate Credit

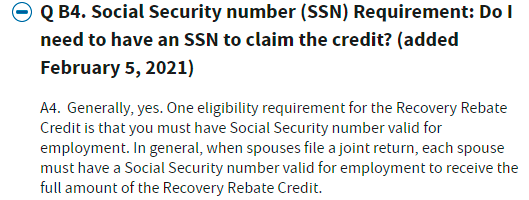

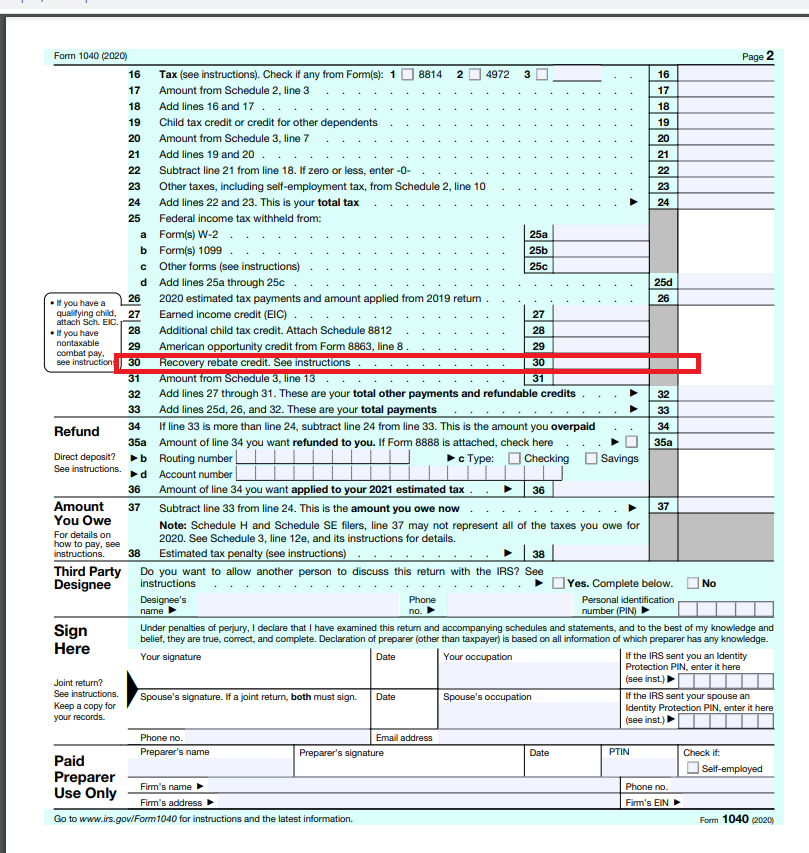

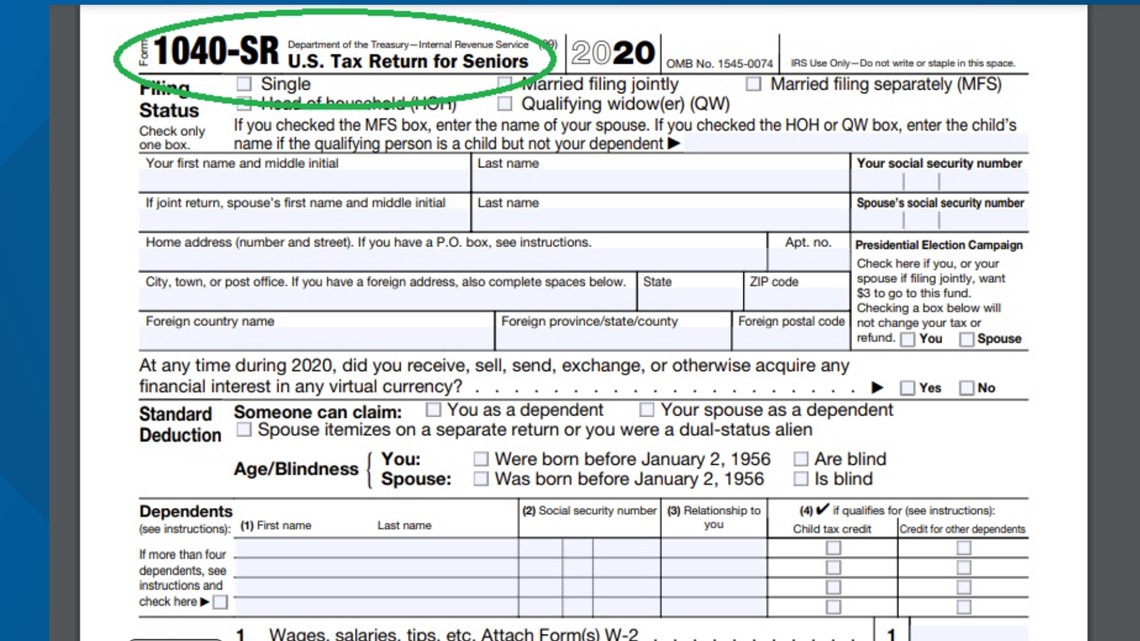

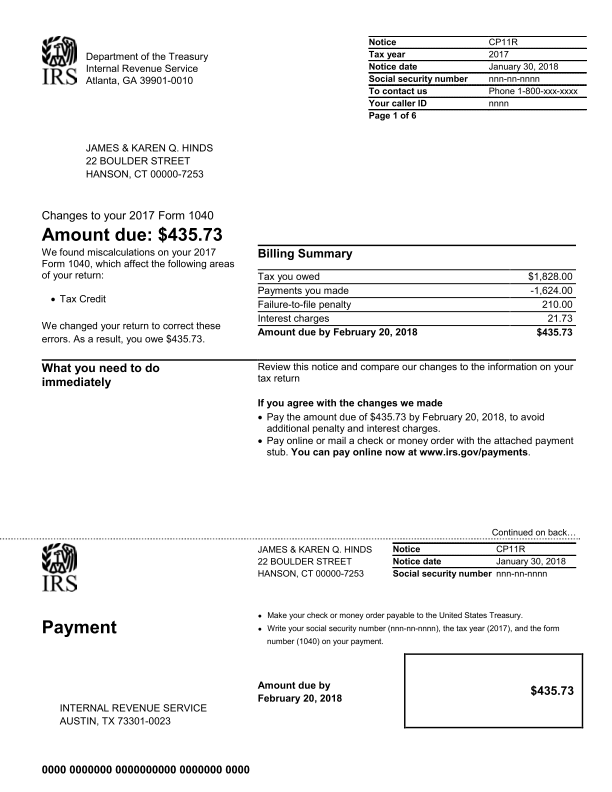

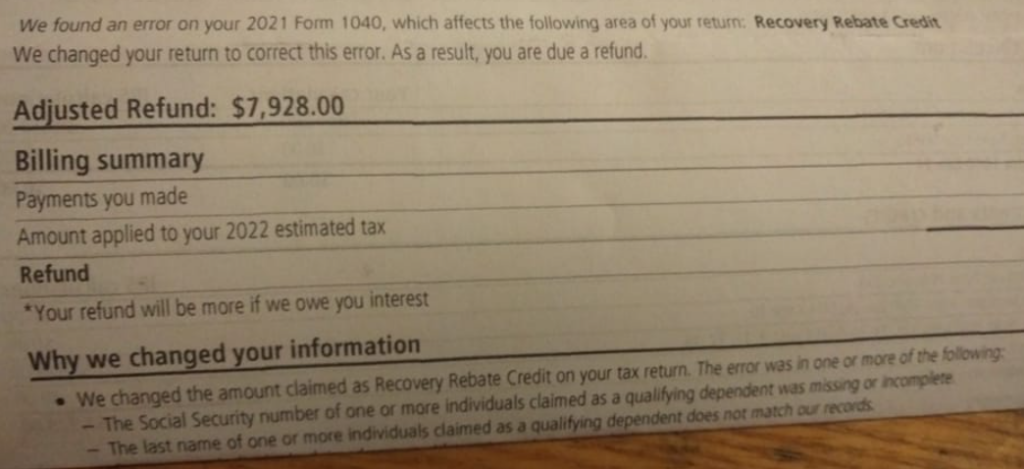

Incorrect Recovery Rebate Credit – The Recovery Rebate is an opportunity taxpayers to claim an amount of tax refund without altering their tax return. The IRS manages the program, which is a free service. It is essential to be familiar with the rules and regulations of the program prior to submitting. Here are some information … Read more