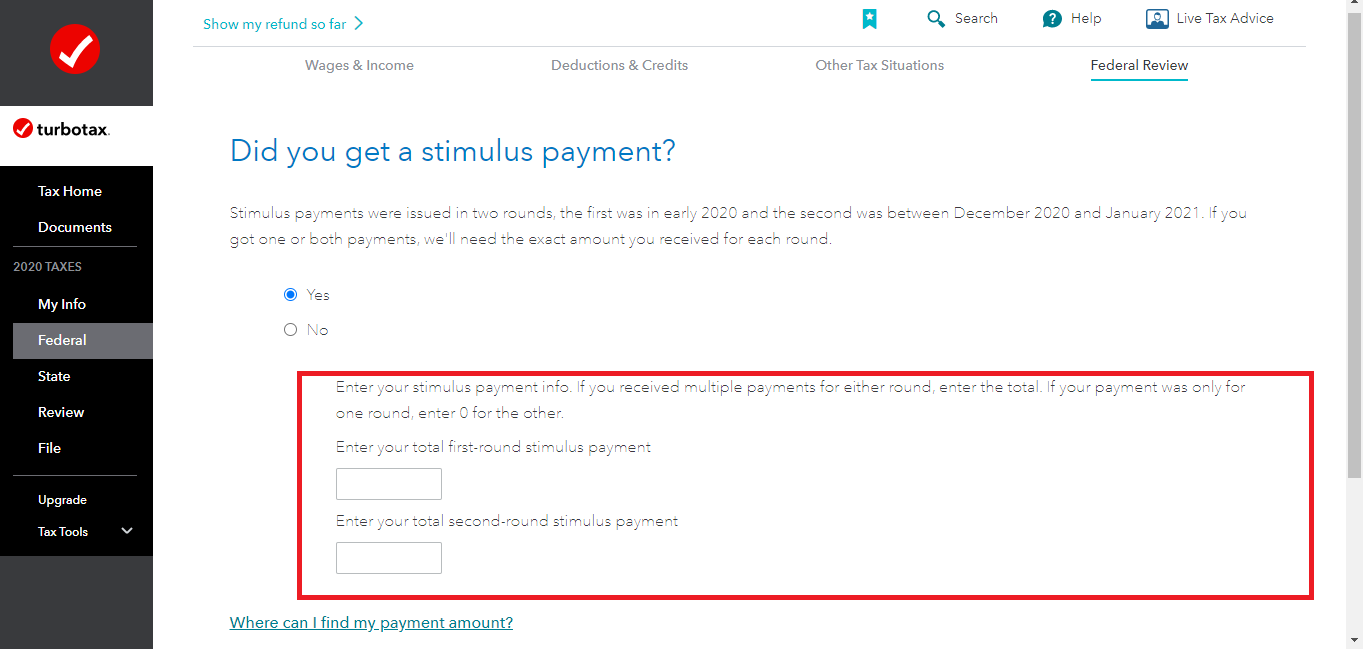

Recovery Rebate Credit Not Showing Up On Turbotax

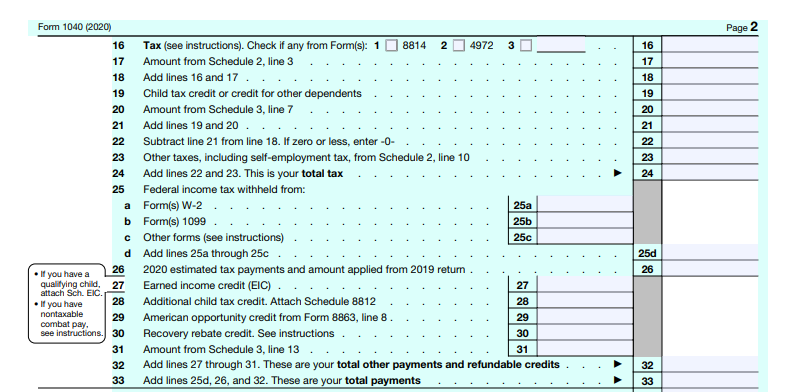

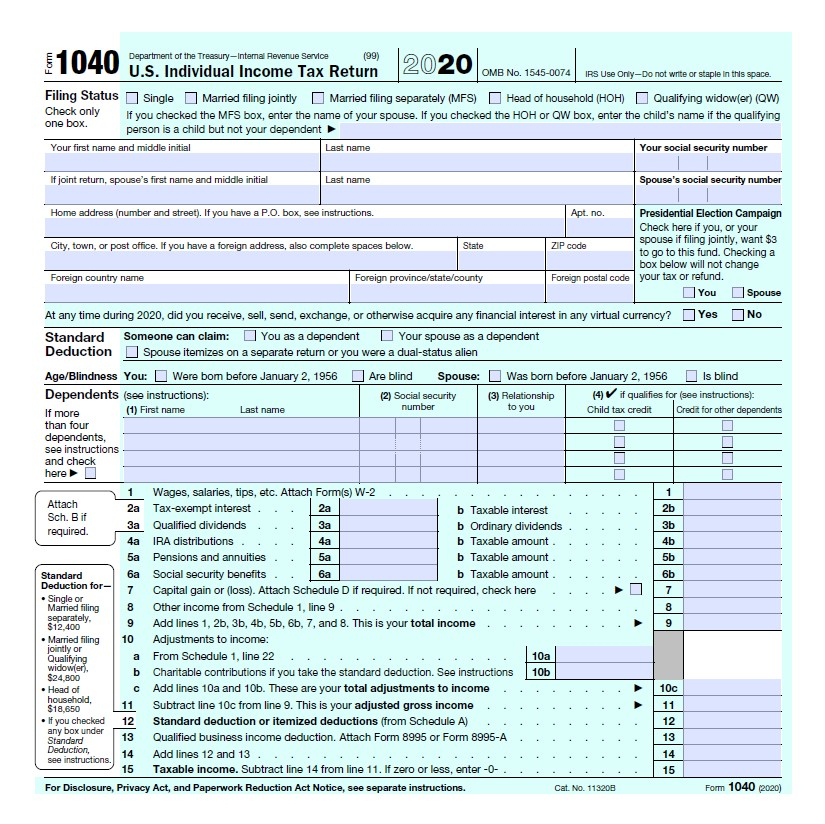

Recovery Rebate Credit Not Showing Up On Turbotax – The Recovery Rebate gives taxpayers an possibility of receiving the tax deduction they earned without having to adjust the tax returns. This program is run by the IRS and is a free service. It is important to be familiar with the guidelines and rules of the … Read more