Can You Do The Recovery Rebate Credit On Turbotax – A Recovery Rebate is an opportunity taxpayers to claim an amount of tax refund without altering their tax return. This program is administered by the IRS. It is essential to be familiar with the guidelines and rules of the program before you submit. Here are some of the things you should be aware of about the program.

Refunds from Recovery Rebate do not have to be adjusted

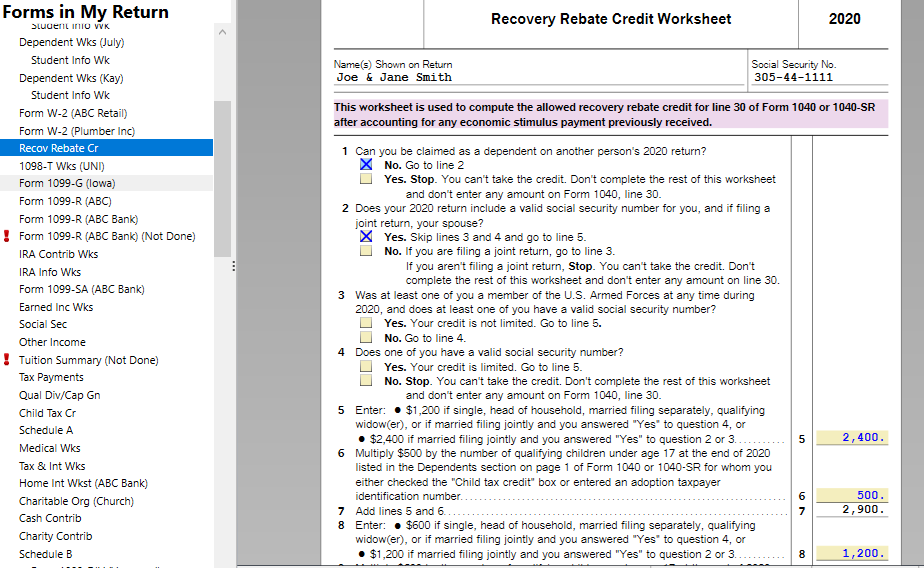

In advance, taxpaying taxpayers eligible to are eligible to receive recovery credits. So, should you have an amount of tax that is higher in 2020 than you did in 2019, you won’t be required to adjust your refund. However your rebate for recovery will be diminished based on your income. Your credit could be cut to zero if the income you have exceeds $75k Joint filers filing jointly with their spouse will see their credit beginning to decrease to $150,000. Heads of household will begin seeing their recovery rebate refunds drop to $112,500.

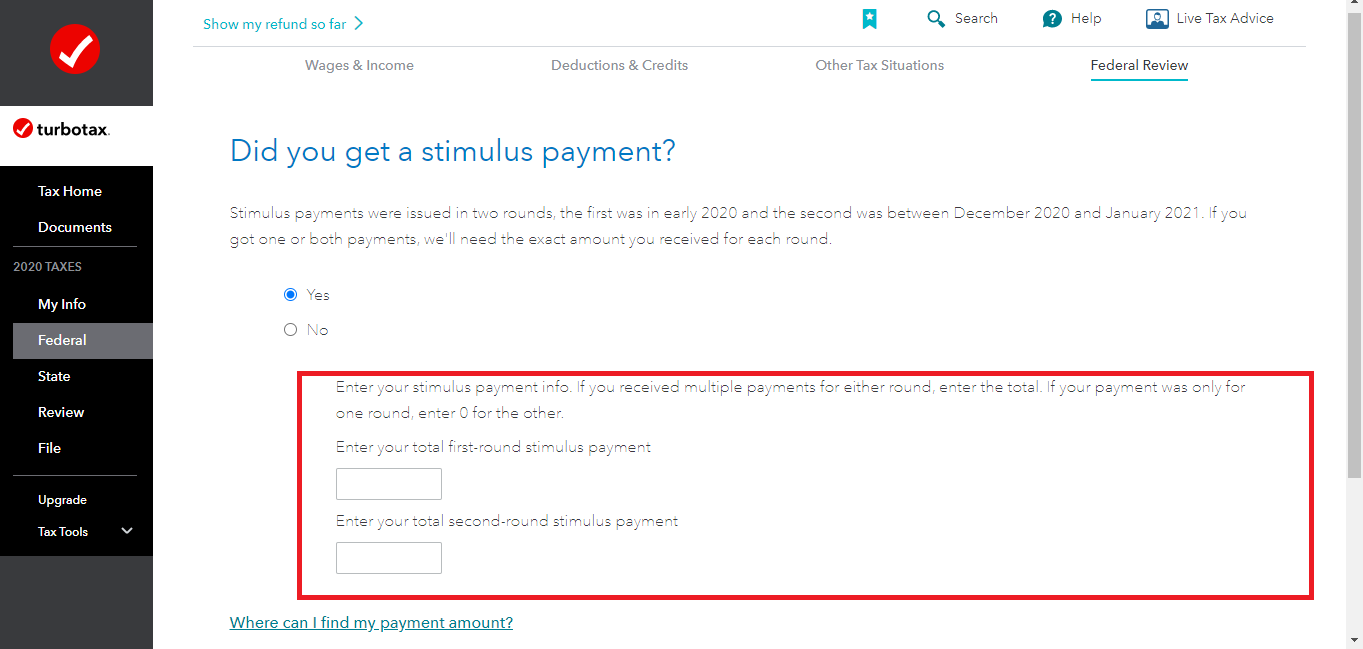

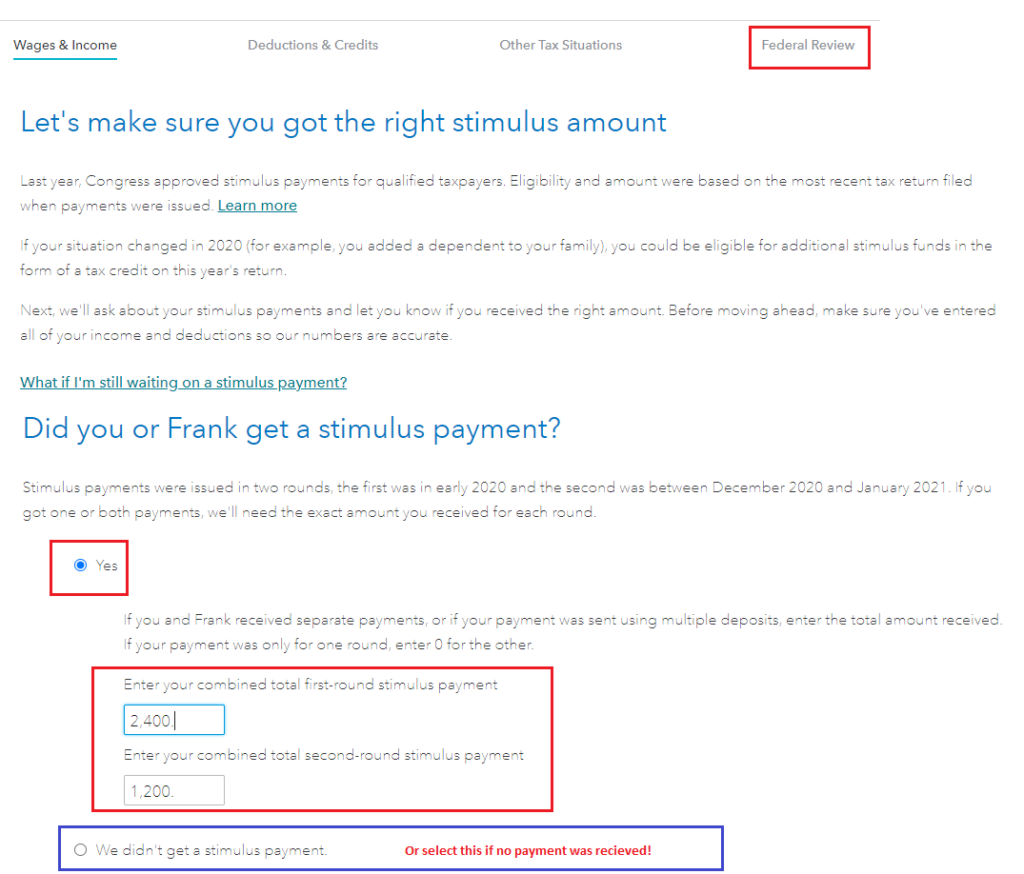

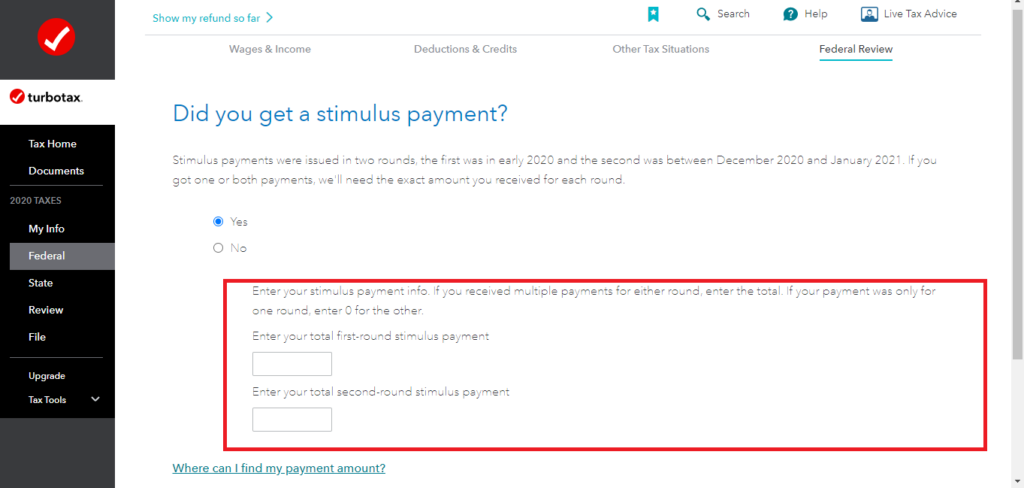

If they did not receive all of the stimulus payments but they still have the option of claiming tax recovery credits in 2020. To be eligible, they’ll require an IRS-registered online bank account along with a printed note detailing the total amount distributed to them.

It does not offer tax refunds

While the Recovery Rebate doesn’t provide you with a tax return it can provide tax credit. IRS has issued warnings about mistakes that are made when applying for the cash stimulus. There have been a few mistakes committed in the field of child tax credit. The IRS will send you a letter in the event that the credit is not used properly.

For 2021, federal tax returns for income will be eligible to receive the Recovery Rebate. For married couples who have at least two kids, you may earn up to $1400, and for single filers up to $4200.

It could be delayed by errors in math or calculations

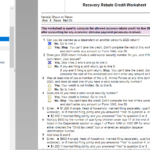

If you receive a letter telling you that the IRS has found a math error on your tax return, it is recommended that you spend a few moments to double-check and adjust the information. Incorrect information could cause your tax refund to be delayed. The IRS provides extensive FAQs to answer your questions.

There are several reasons why your Recovery Rebate may be delayed. Incorrectly claiming child tax credit or stimulus money is among the most frequent causes for delays. The IRS recommends that taxpayers check their tax returns twice in order to confirm that every stimulus money is properly claimed.