Can I Claim The Recovery Rebate Credit – A Recovery Rebate is an opportunity for taxpayers to receive an income tax refund, without having to alter their tax return. The program is offered by the IRS. It is important to know the rules and regulations of this program before submitting. Here are some things to know about this program.

Refunds from Recovery Rebate do not have to be adjusted

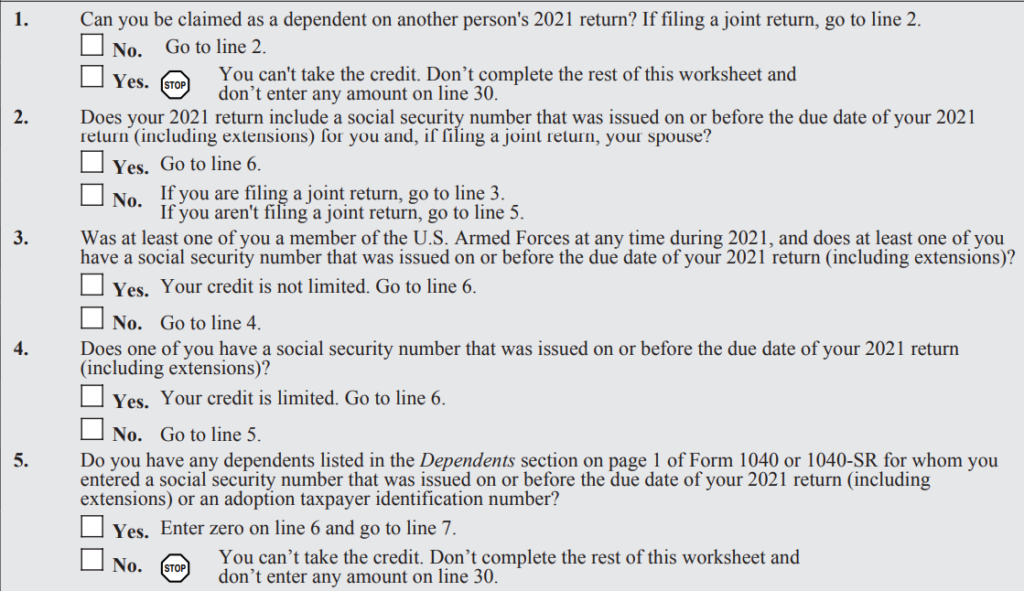

Taxpayers eligible to receive Recovery Rebate credits are notified prior to. So, if you owe more tax in 2020 than you did in the year before, you will not be required to adjust your tax refund. However, depending on the amount of your income, your recovery credit credit may be reduced. Your credit score could be reduced to zero for people who make over $75,000. Joint filers who have spouses will see their credit begin to decline at $150,000. Heads and household members will begin to notice when their reimbursements for recovery rebates start to drop to $112,500.

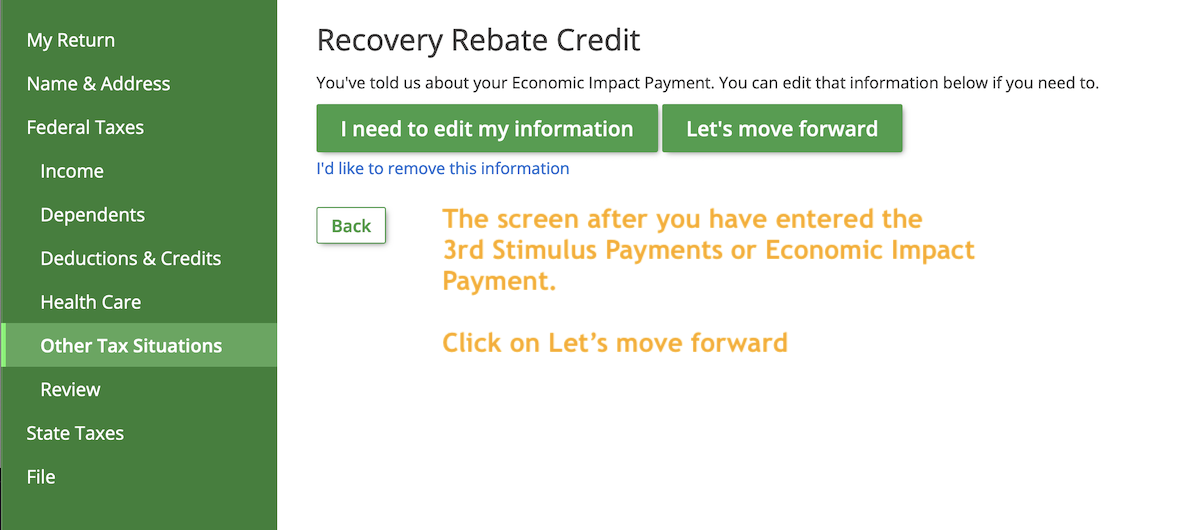

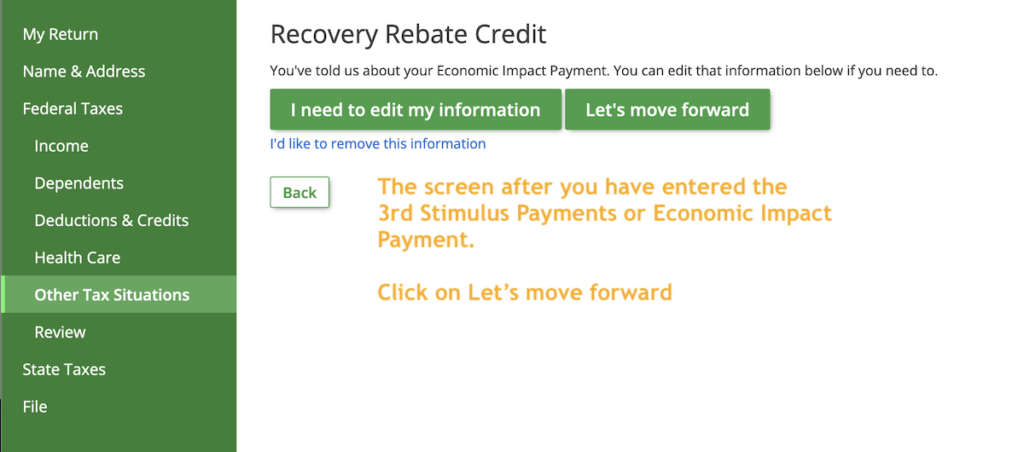

People who did not receive the full stimulus payments may still be eligible to claim recovery credits for tax refunds in 2020. You will need to have an IRS account on the internet and a printed notice listing the total amount they received.

It is not able to provide a refund of tax

The Recovery Rebate does not provide a tax return, but it will grant you the tax credit. The IRS has issued warnings regarding mistakes in the application of this stimulus money. The child tax credit is another area where errors were committed. The IRS will send you a letter in the event that the credit is not used properly.

The Recovery Rebate can be applied to federal income tax returns that are filed up to 2021. If you’re a married couple with two children , and qualify as a tax dependent, you can get up to $1,400 or $4200 for filers who are single.

It could delay due to mistakes in math or calculations

If you receive a letter from the IRS that says that there was an error in math in your tax return spend a few minutes to review your tax return and make any necessary adjustments. If you don’t provide correct information, your refund may be delayed. The IRS provides a variety of FAQs to answer your questions.

There are many reasons why your recovery refund may not be processed as scheduled. Incorrectly claiming child tax credit or stimulus funds is among the most common reasons for delays. The IRS is advising taxpayers to check their tax returns and ensure that they are correctly claiming each stimulus payment.