Calculate Recovery Rebate Credit 2022 – Taxpayers are eligible for an income tax credit via the Recovery Rebate program. This permits them to claim a refund of their taxes without having to amend their tax returns. This program is run by the IRS and is a free service. It is important to understand the rules and regulations of this program prior to submitting. These are some points you need to be aware of about the program.

Recovery Rebate reimbursements don’t have to be adjusted.

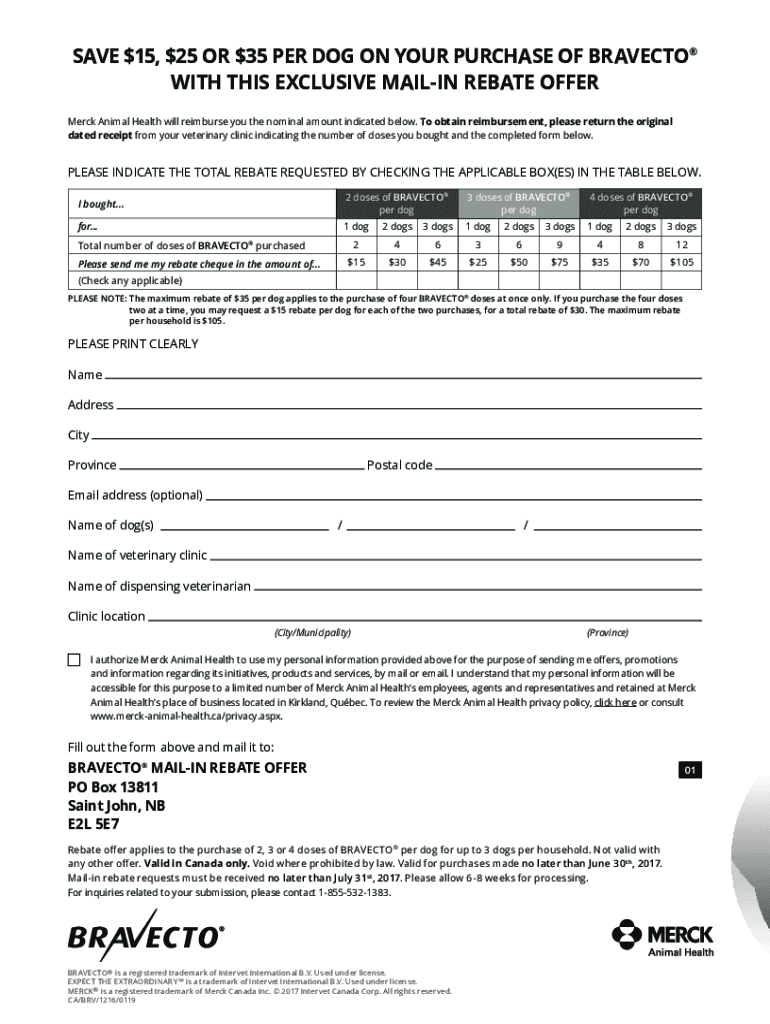

The eligible taxpayers will receive the Recovery Rebate credit in advance. So, even if you pay an amount of tax that is higher in 2020 than in 2019, you won’t be required to adjust your refund. Your income may influence the amount you can claim as the recovery credit. Your credit rating will decrease to zero if your income exceeds $75,000. Joint filers with spouses will begin to decrease at $150,000. Heads of households will begin to see their recovery rebate refunds decreased to $112,500.

People who did not receive the full amount of stimulus funds can still claim recovery rebate credits on their taxes in 2020. They will need an IRS online account and an acknowledgement of all amounts they’ve received.

It doesn’t offer any tax refund.

While the Recovery Rebate will not give you a refund on your tax bill, it will grant taxpayers with tax credits. IRS has warned taxpayers against doing things wrong when applying for this stimulus money. Another area where mistakes were made was the tax credit for children. The IRS will send a letter to you if the credit is not used correctly.

The Recovery Rebate can be applied to federal income tax returns from now to 2021. Each tax dependent is eligible to receive as much as $1400 (married couples with 2 children) or up to $4200 (single filers).

It is possible to delay it due to mistakes in math or calculations

If you get a letter from the IRS informing you there is a math error in your tax return spend a few minutes to review your tax return and make any necessary adjustments. You may have to wait for your refund if you provide incorrect details. Find answers to your queries in the extensive FAQ section of IRS.

There are a variety of reasons for why your rebate might not be processed in time. One of the most frequently cited is an error in the claim of stimulus money or the tax credit for children. The IRS suggests that taxpayers double-check their tax returns in order to make sure they are claiming every stimulus payment.