Amended Tax Return Recovery Rebate Credit – The Recovery Rebate allows taxpayers to receive a tax refund without having to modify the tax return. This program is offered by the IRS. It’s cost-free. It is essential to familiarize yourself with the regulations before applying. Here are some information regarding this program.

Recovery Rebate reimbursements don’t have to be adjusted.

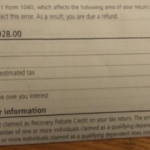

Recovery Rebate credits are paid to taxpaying taxpayers who are eligible in advance. If you owe tax more in 2020 than in 2019 your refund will not be adjusted. However your rebate for recovery will be diminished depending on your income. If you earn more than $75k, your credits will be reduced to zero. Joint filers will see their credit reduced to $150,000 for married couples. Heads of household will also see their rebates decrease to $112,500.

The people who did not get full stimulus payments may get recovery rebates for their taxes in 2020. In order to be eligible for this credit it is necessary to establish an online IRS account and supply a copy of the money that was given to them.

It is not able to be used for a tax return

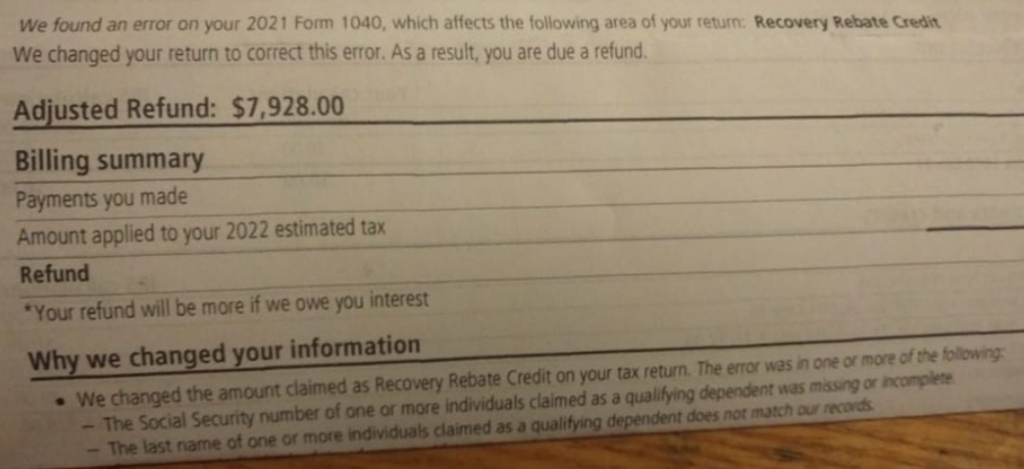

While the Recovery Rebate will not give you a refund on your taxes, it will provide taxpayers with tax credits. The IRS has issued warnings about errors in the process of declaring this stimulus funds. The IRS has also made errors in the application of the tax credits for children. If the credit isn’t correctly applied, you will receive an email from the IRS.

The Recovery Rebate is available for federal income tax returns up to 2021. Each tax dependent can be eligible to receive as much as $1400 (married couples with two children) or up to $4200 (single taxpayers).

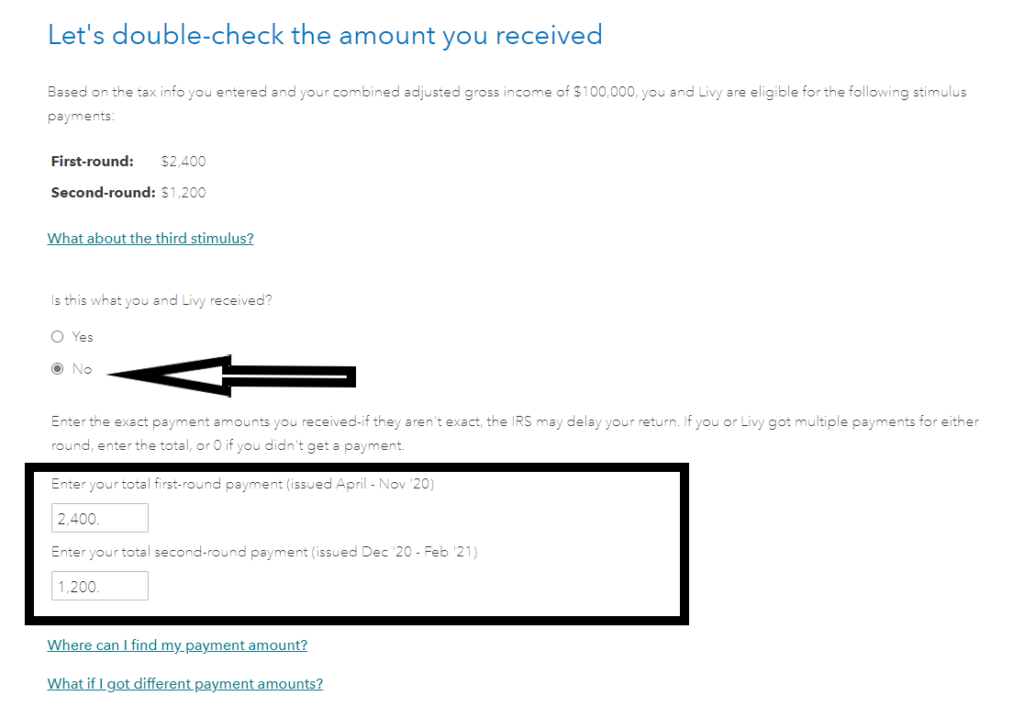

It may be delayed due to mistakes in math or calculations

If you receive a letter informing you that the IRS has found a math mistake on your tax return, spend a few moments to check and correct your tax return information. If you don’t provide accurate information, your refund may be delayed. You can find answers to your queries in the vast FAQ section on IRS.

There are many reasons your Recovery Rebate might be delayed. The most common reason is that you have not done the right thing when you claim the stimulus money or child tax credit. The IRS has warned taxpayers to double-check tax returns and ensure they declare every stimulus check correctly.