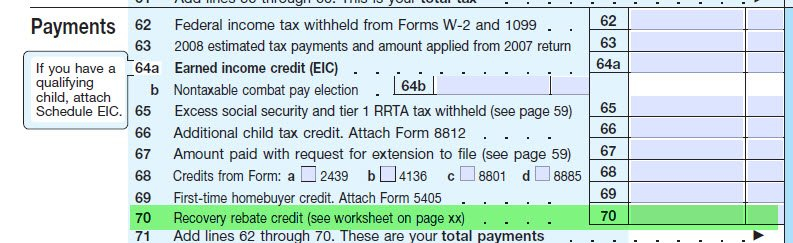

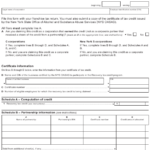

Application For Recovery Rebate Credit – The Recovery Rebate is an opportunity for taxpayers to get a tax refund without adjusting their tax return. This program is run by the IRS and is a no-cost service. However, it is crucial to understand the regulations and rules regarding this program before you file. These are just a few facts about this program.

Recovery Rebate Refunds are not subject to adjustment

Taxpayers who qualify are eligible to get Recovery Rebate credits in advance. This means you won’t have to alter the amount of your refund if you are liable for higher taxes in 2020 than you did in 2019. Your income will impact the amount of your recovery rebate credit. Your credit score will fall to zero when you earn more than $75,000. Joint filers with spouses will see their credit drop to $150,000. Heads of households will have their reimbursements for recovery rebates reduced to $112,500.

Individuals who weren’t able to receive all of the stimulus payments could be eligible for credits for tax refunds in 2020. In order to be eligible they’ll require an IRS-registered online bank account and a paper note detailing the total amount they will receive.

It does not provide an opportunity to receive a tax refund

Although the Recovery Rebate will not give you a tax refund, it will give you tax bill, it will grant you with tax credits. IRS has warned you about doing things wrong when applying for this stimulus money. Another area where errors were made is the tax credit for children. The IRS will send a notice to you in the event that the credit was not applied correctly.

The Recovery Rebate can be applied to federal income tax returns from now to 2021. A qualified tax dependent can receive up $1,400 (married couples having two children) or $4200 (single filers).

It can be delayed due to math mistakes or miscalculations

It is important to double-check the information you have provided and make any necessary adjustments when you receive a notice from IRS informing you that there’s a math error in the tax return. If you don’t provide accurate information, your tax refund may be delayed. The IRS has a wealth of FAQs available to answer your concerns.

There are many reasons why your recovery rebate might not be processed as scheduled. Most common reason for delay is due to a mistake made when filing a tax credit or stimulus money. The IRS recommends that taxpayers check their tax returns twice in order to ensure that every stimulus money is claimed correctly.