Amend Recovery Rebate Credit – The Recovery Rebate allows taxpayers to get a tax refund, without the need to alter their tax returns. This program is run by the IRS. It’s completely cost-free. It is crucial to know the guidelines and rules of the program prior to submitting. These are only some of the facts regarding this program.

Recovery Rebate refunds do not require adjustments

Taxpayers who qualify to receive Recovery Rebate credits are notified prior to. This means that your refund won’t be affected if you owe more tax in 2020 compared to 2019. Your income will influence the amount of your recovery rebate credit. Your credit score will drop to zero if your income exceeds $75,000. Joint filers filing jointly with their spouse will notice their credit dipping at $150,000. Heads of household will start to see their reimbursement refunds drop to $112,500.

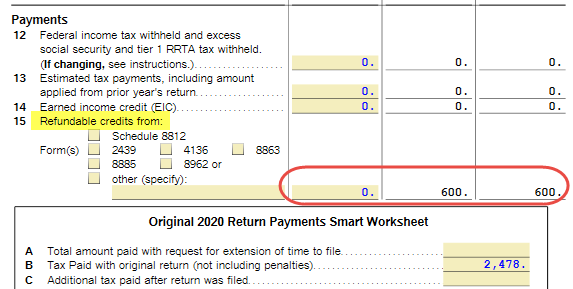

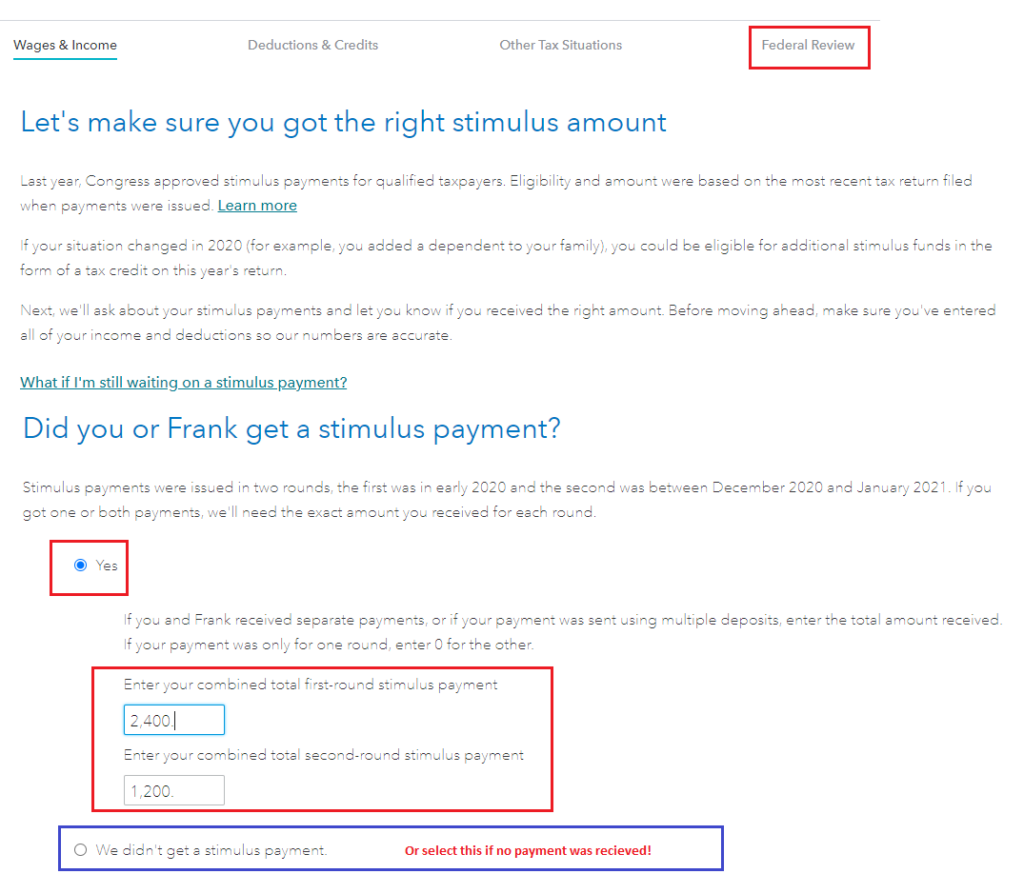

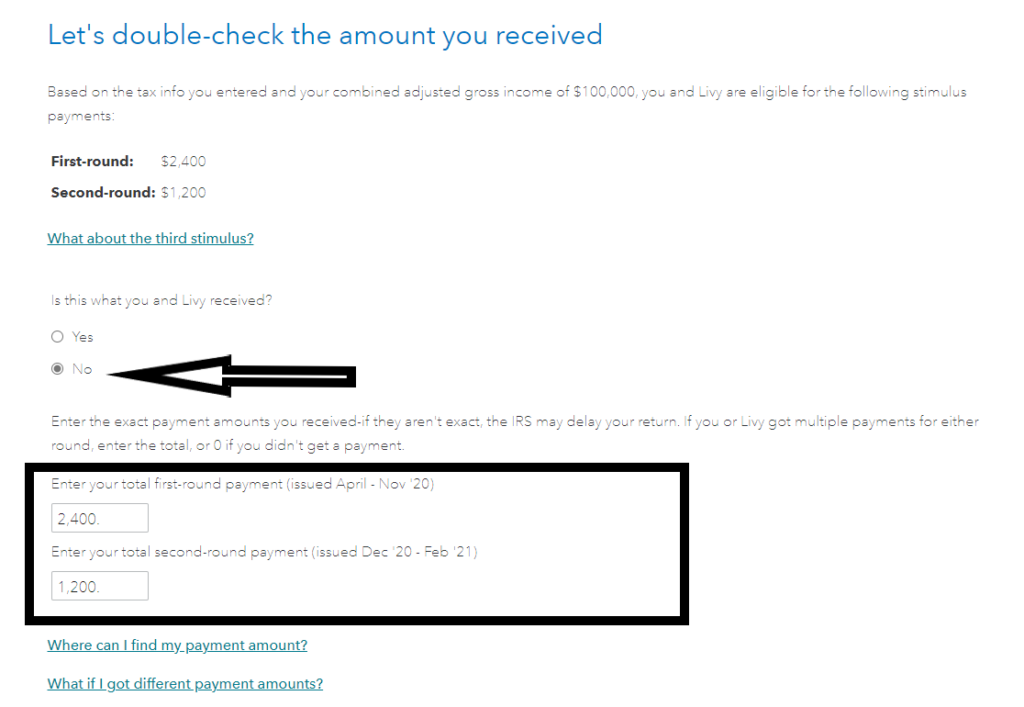

While they may not have received the full stimulus payment People can still claim refund rebate credits towards their taxes in 2020. They’ll require an IRS online account and an acknowledgement of all amounts they’ve received.

It doesn’t provide tax refunds

Although the Recovery Rebate will not give you a refund on your taxes, it will provide taxpayers with tax credits. IRS has cautioned people about the mistakes they made when applying for the stimulus funds. Child tax credits are another area where mistakes were committed. The IRS will send you a letter in the event that the credit is not applied correctly.

The Recovery Rebate is available for federal income tax returns up to 2021. Each tax dependent can be qualified for as much as $1400 (married couples with two children) or up to $4200 (single filers).

It could also be delayed by math errors and miscalculations

You should double-check your information and make any changes in the event that you receive a letter from IRS notifying you of an error in math on your tax return. If you do not provide correct information, your refund may be delayed. Fortunately that the IRS offers an extensive FAQ section to answer your questions.

There are a variety of reasons your Recovery Rebate might be delayed. Most common reason for delay is a miscalculation in filing a tax credits or stimulus funds. The IRS recommends that taxpayers check their tax returns twice in order to confirm that every stimulus amount is declared correctly.