Hr Block Recovery Rebate Credit – The Recovery Rebate gives taxpayers an chance to get an income tax refund without the need to alter their tax returns. This program is administered by the IRS and is a free service. It is crucial to understand the rules and regulations of this program prior to submitting. Here are some information regarding this program.

Recovery Rebate reimbursements don’t have to be adjusted.

In advance, taxpaying taxpayers eligible to get credit for recovery. This means you won’t need to change the amount of your tax refund if you have higher tax obligations in 2020 than for 2019. However, your recovery rebate credit could be reduced according to your income. If you earn over $75k, your credit could decrease to zero. Joint filers who file jointly with a spouse will see their credit starting to decline at $150,000. Heads of household will begin to see their reimbursement reductions fall to $112,500.

People who did not receive the full stimulus payments may still be eligible to claim recovery credits for tax refunds in 2020. To be eligible to claim this credit, they must create an online IRS account and submit an exact copy of the amount given to them.

It does not provide a tax refund

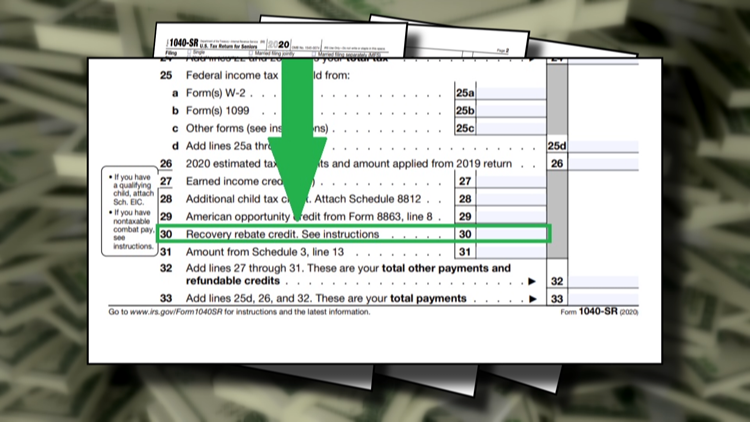

Although the Recovery Rebate does NOT provide a tax return for you but it does give tax credits. IRS has warned about potential mistakes in claiming the stimulus funds. The IRS also made errors in the application of tax credits for children. If the credit hasn’t been applied correctly, the IRS will send you an email.

The Recovery Rebate can be applied to federal income tax returns up to 2021. A qualified tax dependent may receive up to $1400 (married couples with two children) or $4200 (single taxpayers).

It could be delayed because of mistakes in math or calculations

If you are sent an email from the IRS notifying you that there is an error in the math on the tax return, make sure you take the time to review and correct the error. The incorrect information could result in your tax refund being delayed. The IRS offers a wide range of FAQs that can answer your questions.

There are a variety of reasons your recovery refund could be delayed. The most common cause for delay is a miscalculation in the tax credit or stimulus money. The IRS encourages taxpayers to double-check their tax returns in order to confirm that every stimulus amount is declared correctly.