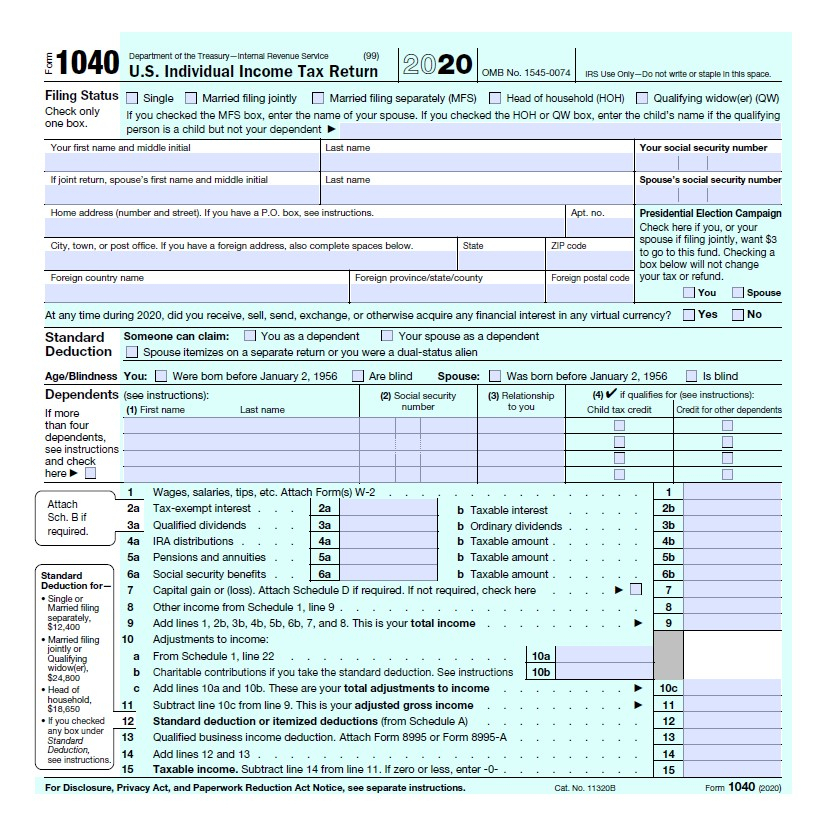

2022 Recovery Rebate Credit Stimulus Check 2022 – A Recovery Rebate is an opportunity for taxpayers to get an amount of tax refund without altering their tax return. The IRS administers the program that is a no-cost service. Prior to filing however, it’s important that you are familiar of the regulations and guidelines of the program. Here are some information about the program.

Recovery Rebate funds are not subject to adjustment.

Taxpayers who qualify will be eligible to receive the Recovery Rebate credit prior to. There is no need to alter your refund if your 2020 tax bill is more than the 2019 one. However the recovery rebate credit may reduce based on your income. Your credit will be reduced to zero if the income you have exceeds $75k Joint filers who file jointly with a spouse will notice their credit dipping to $150,000. Heads of household will start to see their reimbursement reductions fall to $112,500.

Individuals who didn’t receive full stimulus payments may still be eligible for recovery rebate credits on their tax returns in 2020. To qualify for this credit, they must create an online IRS account and submit a copy of the amount that was given to them.

It is not able to provide any tax refund

The Recovery Rebate does not provide the tax-free status, but it does grant you the tax credit. IRS has warned of potential mistakes in claiming the stimulus funds. There have been mistakes committed in the field of child tax credits. The IRS will issue a notice if the credit is not used properly.

In 2021, Federal income tax returns for 2021 are eligible for the Recovery Rebate. Tax-qualified tax dependents could receive up to $1,400 (married couples with two children) or $4200 (single filers).

It may be delayed due to math errors or miscalculations

If you receive a notice with the message that the IRS has found a math mistake on your tax return, you should take a moment to check and correct your tax return information. You may have to wait until you receive your tax refund if you provided inaccurate details. The IRS offers a wide range of FAQs that can answer your questions.

There are several reasons why your recovery reimbursement could be delayed. The most frequent reason why that your recovery payment could delay is because there was a mistake when making an application for stimulus money and the child tax credit. The IRS recommends that taxpayers check their tax returns twice to verify that each stimulus money is properly claimed.