2023 Tax Return To Claim The 2023 Recovery Rebate Credit – Taxpayers can receive tax credits through the Recovery Rebate program. This allows them to claim a refund of their taxes without the need to amend their tax returns. The IRS manages the program that is a no-cost service. It is essential to know the guidelines and rules of the program before you submit. Here are some specifics about the program.

Recovery Rebate refunds do not need to be adjusted

The eligible taxpayers will receive the Recovery Rebate credit in advance. You don’t have to adjust your refund if your tax bill is more than the 2019 one. However the recovery rebate credit could be reduced depending on your income. Your credit score could be reduced to zero for people who make more than $75,000. Joint filers with spouses will drop to $150,000. Heads of households will begin to have their reimbursements for recovery rebates reduced to $112,500.

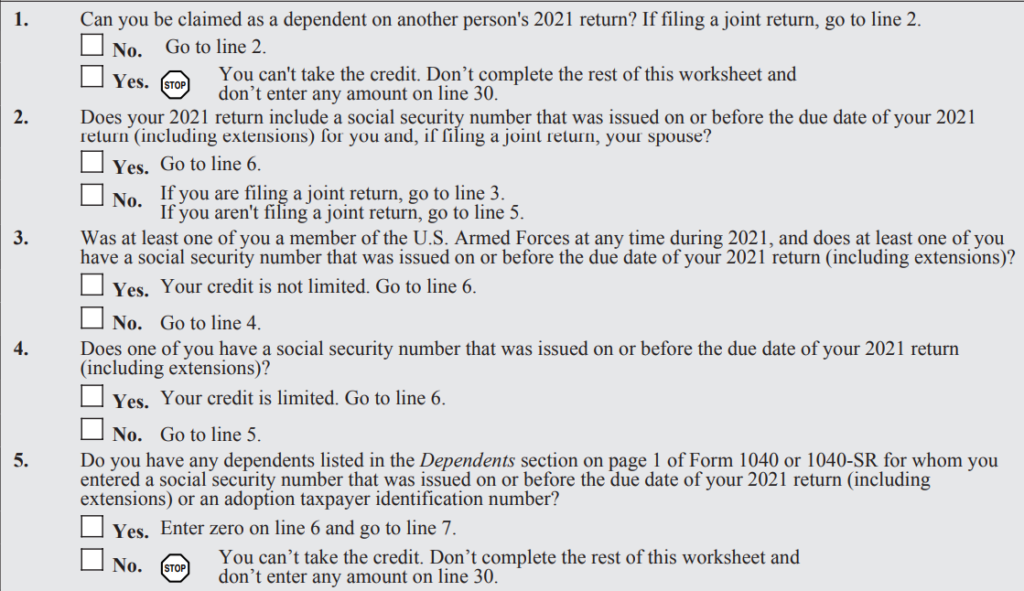

Individuals who didn’t receive full stimulus funds may be eligible to claim recovery credits for tax refunds for 2020. In order to be eligible to claim this credit you must open an online IRS account and submit an exact copy of the amount given to them.

It doesn’t offer any tax refund.

While the Recovery Rebate does NOT provide a tax return for you, it does provide tax credits. IRS has issued warnings regarding errors made when claiming this stimulus cash. The child tax credit is another area where mistakes were committed. The IRS will send you a letter if the credit is not used properly.

For 2021 the federal tax returns on income are eligible to receive the Recovery Rebate. You can get as much as $1,400 for each tax dependent who is eligible (married couples with two kids) and up to $4200 for single filers.

It could be delayed because of math errors or miscalculations

If you receive an official letter from the IRS notifying you that there is an error in the math on the tax return, make sure you take the time to review and correct the error. If you do not provide accurate information, your refund may be delayed. The IRS offers a wide range of FAQs to help you answer any questions.

There are several reasons why your Recovery Rebate may be delayed. The most frequent reason why the reason your recovery refund could be delayed is due to the fact that there was a mistake while applying for the stimulus funds and the child tax credit. The IRS recommends that people double-check their tax returns in order to be sure that they are declaring every stimulus payment.