2023 Recovery Rebate Credit Income Limits – The Recovery Rebate allows taxpayers to get a tax refund without the need to alter their tax returns. The program is managed by the IRS and is a completely free service. It is crucial to know the rules and regulations of the program prior to submitting. Here are a few points to know about the program.

Refunds from Recovery Rebate do not have to be adjusted

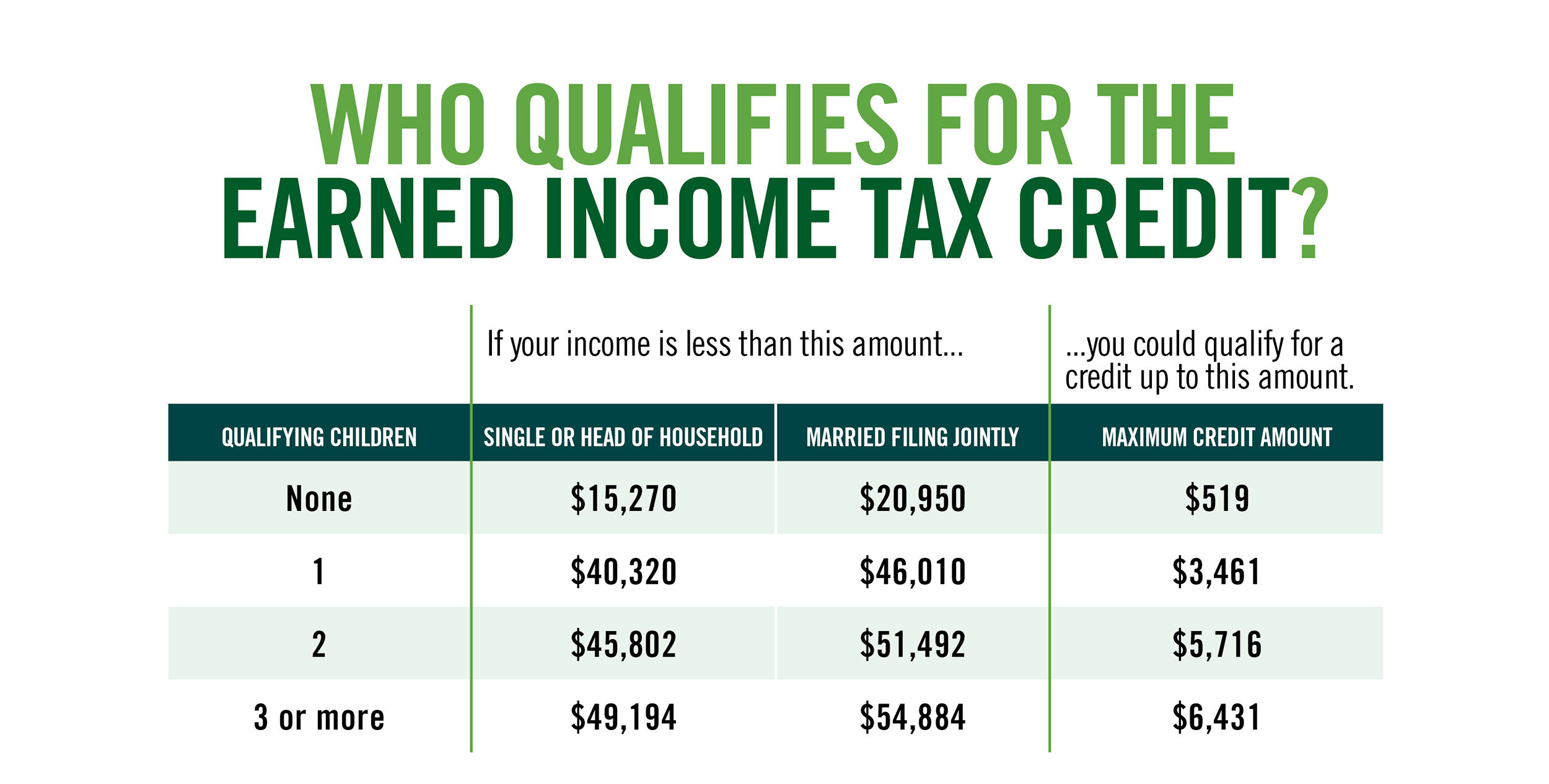

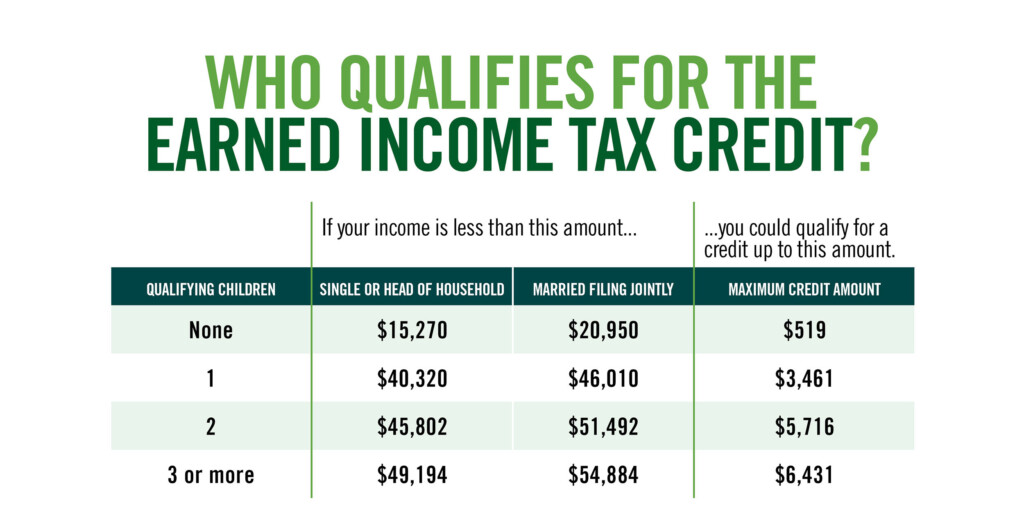

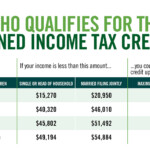

Recovery Rebate credits are distributed to eligible taxpayers in advance. That means your tax refund won’t be affected if you are owed more taxes in 2020 as compared to 2019. Your income could determine the amount you get the recovery credit. Your credit score could drop to zero for those who earn over $75,000. Joint filers with a spouse will see their credit begin to decrease at $150,000. Heads of households will receive their rebates for recovery reduced to $112,500.

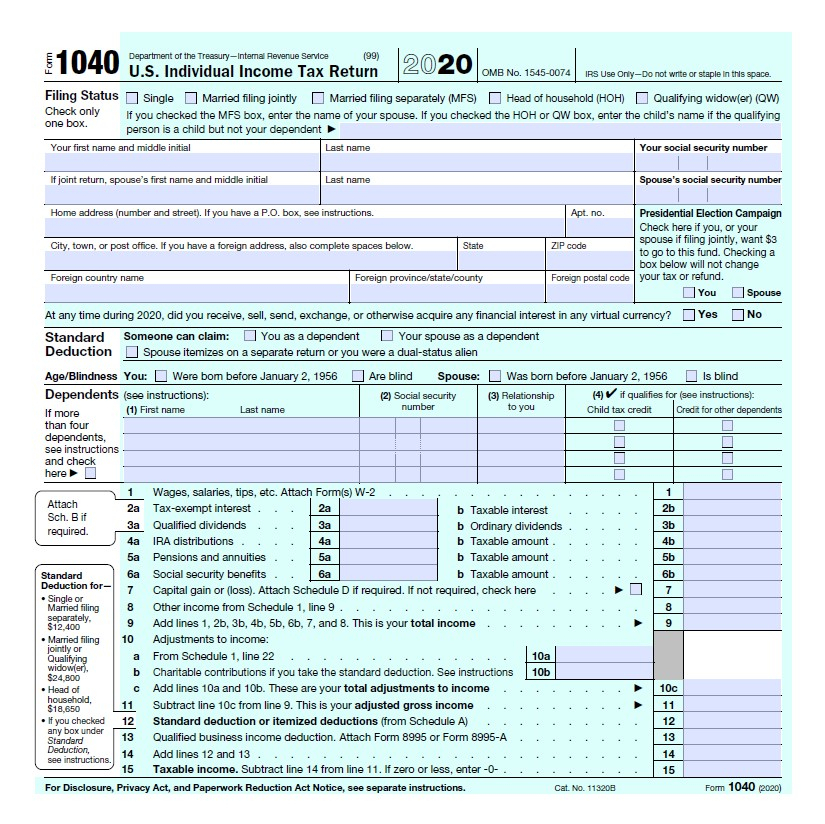

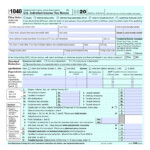

Even if they did not receive all of the stimulus funds, they can still claim tax credits for 2020. You will need to have an IRS account online , as well as an official printed document stating the amount you received.

It is not able to be used the tax return to be filed.

Although the Recovery Rebate doesn’t provide you with a tax return it can provide tax credit. IRS has warned taxpayers about doing things wrong when applying for the stimulus money. The IRS has also made mistakes in the application of tax credits for children. If the credit isn’t applied correctly then the IRS will notify you via email.

The Recovery Rebate is available on federal income tax returns for 2021. You could receive up to $1,400 per tax dependent who is eligible (married couples with two kids) and up to $4200 for single filers.

It is possible to delay it due to mistakes in math or calculations

If you get a letter by the IRS stating that there was an error in the math on your tax returns, make sure you take some time to look it up and correct it. Incorrect information can cause your refund to be delayed. The IRS has a wealth of FAQs to answer your questions.

There are many reasons your recovery rebate might be delayed. The most common cause for delay is a miscalculation in filing a tax credits or stimulus funds. The IRS recommends that taxpayers double-check their tax returns in order to ensure that every stimulus payment is being claimed correctly.