2023 Irs Recovery Rebate Credit – The Recovery Rebate is an opportunity for taxpayers to receive a tax refund without adjusting their tax returns. The program is provided by the IRS. It is cost-free. However, it is essential to be aware of the regulations and rules governing the program prior to filing. Here are some things to be aware of about this program.

Recovery Rebate Refunds are not subject to adjustment

Recovery Rebate credits are distributed to taxpayers eligible for them in advance. If you owe more taxes in 2020 than you did in 2019 your refund is not adjusted. But, based on the amount of your income, your recovery credit might be reduced. If you earn over $75k, your credit could be reduced to zero. Joint filers who file jointly with their spouse will see their credit dipping at $150,000. Heads of households will begin to see their recovery rebate reimbursements decrease to $112,500.

People who have not received full stimulus payments in 2020 are still eligible to receive credit for recovery rebates. You’ll need an IRS account online and a printed notice listing the total amount they received.

It doesn’t offer a tax refund

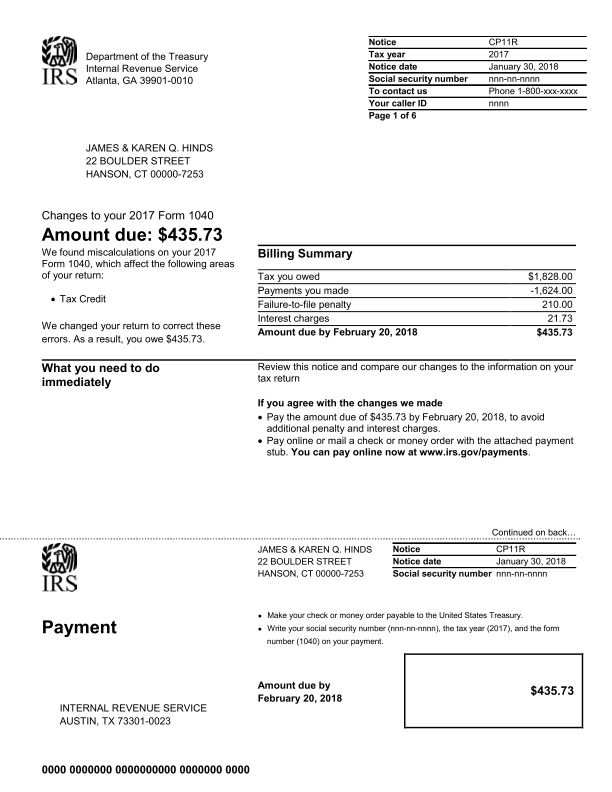

The Recovery Rebate does not provide an income tax return, however it does grant you an income tax credit. IRS has warned about potential mistakes when claiming this stimulus money. The tax credit for children is another area where mistakes were made. In the event that the credit isn’t properly applied, you will receive an official letter from the IRS.

For 2021, federal tax returns on income are eligible to receive the Recovery Rebate. Tax dependents who qualify could receive up to $1,400 (married couples having two children) or $4200 (single tax filers).

It could be delayed by errors in math or calculations

If you receive an email from the IRS informing you that there was an error in maths in your tax returns, take some time to look it up and rectify it. You might have to wait until you receive your refund if you provide inaccurate information. The IRS has a wealth of FAQs to help you with your questions.

There are several reasons why your recovery rebate may be delayed. An error in the way you claim the child tax credit or stimulus money is one of the most frequently cited reasons for a delay. The IRS has advised taxpayers to check their tax returns and be sure they’re reporting each stimulus payout.