202 Recovery Rebate Credit – The Recovery Rebate offers taxpayers the chance to get an income tax return, with no tax return modified. The IRS manages the program that is a no-cost service. Prior to filing however, it’s important that you are familiar with the regulations and rules of the program. Here are some specifics about the program.

Recovery Rebate refunds do not require adjustments

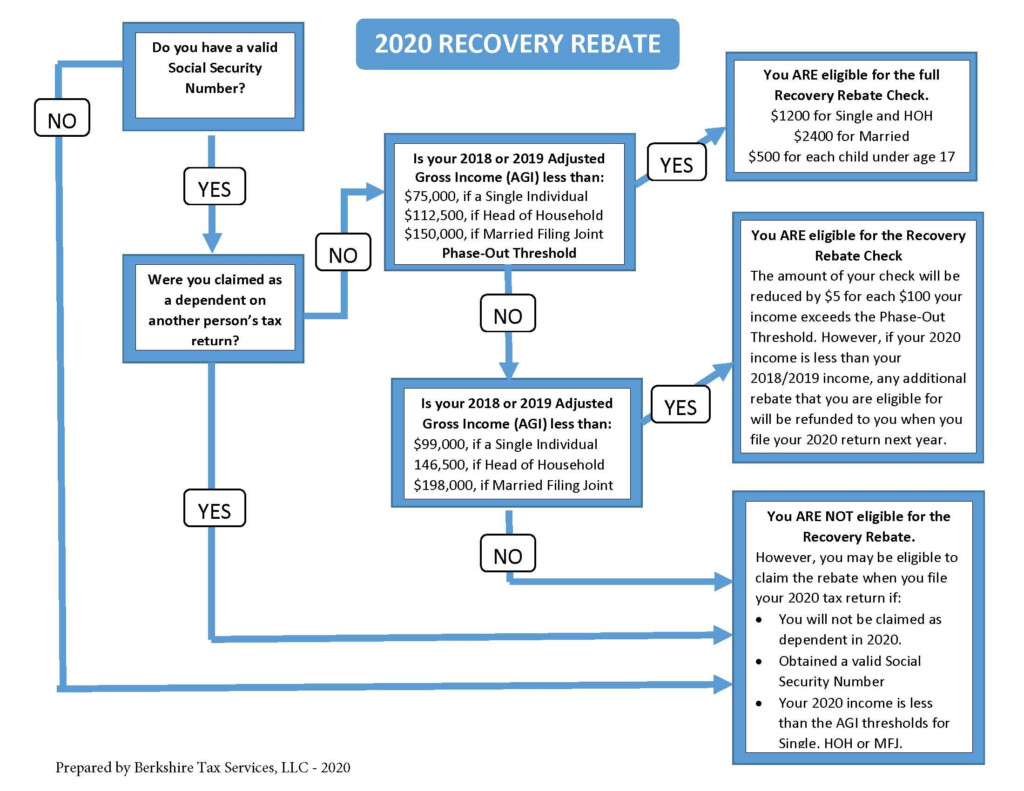

Taxpayers who are eligible to receive Recovery Rebate credits will be informed in advance. This means that you do not have to alter the amount of your refund if have higher tax obligations in 2020 than for the year 2019. However, your recovery rebate credit will be diminished according to your income. Your credit rating will drop to zero If you earn more that $75,000. Joint filers who file jointly with a spouse, will see their credit decline to $150,000. Heads of households and joint filers will begin to see the rebates decrease to $112,500.

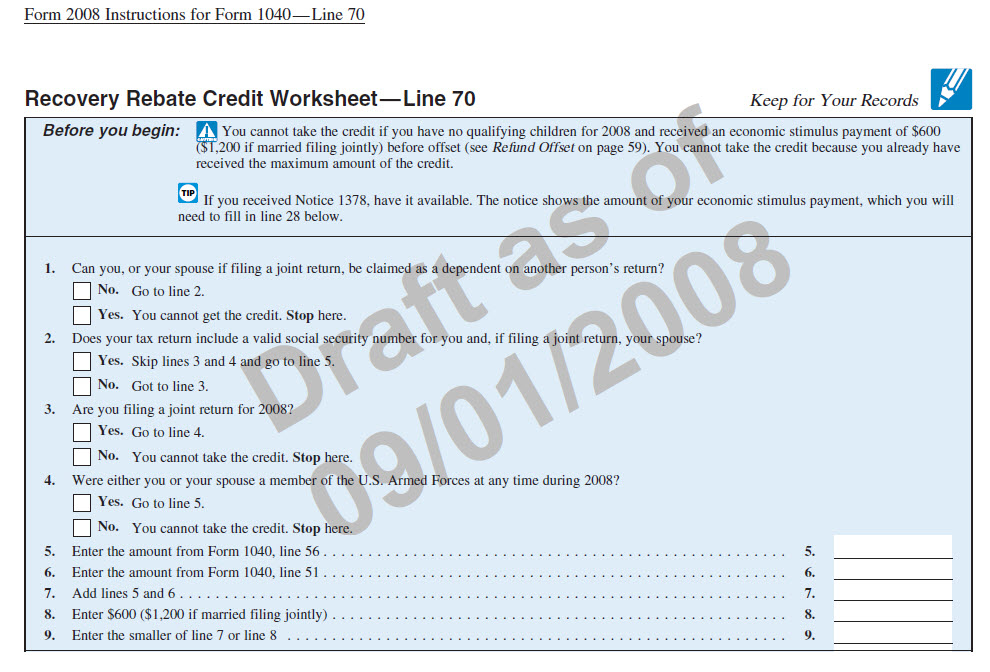

Even if they didn’t receive all of the stimulus payments, they can still claim tax recovery credits in 2020. You’ll need an IRS account online and an official notice in writing stating the total amount they received.

It does not allow the tax return to be filed.

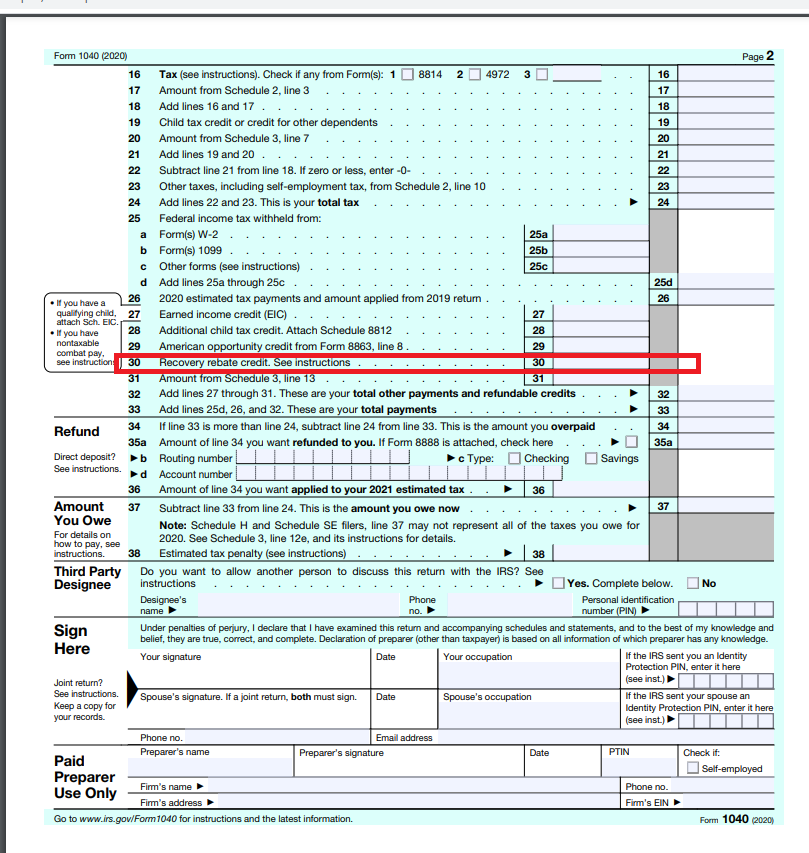

Although the Recovery Rebate doesn’t provide you with a tax return , it does provide you a tax credit. IRS has warned people about their mistakes when applying for this stimulus funds. Child tax credits are another area where mistakes were made. The IRS will send you a letter if the credit is not used properly.

In 2021, federal tax returns on income are eligible for the Recovery Rebate. You could receive up to $1,400 for each tax dependent who is eligible (married couples with two kids) and up to $4200 for single filers.

It could be delayed due to mathematical mistakes or miscalculations

If you get an official letter from the IRS notifying you that there is an error in maths in your tax returns, you should take some time to check and rectify the error. If you don’t provide correct details, your refund could be delayed. Fortunately, the IRS has an extensive FAQ section that can answer your questions.

There are many reasons that your refund for the recovery program could be delayed. The most frequent reason is because you made a mistake when claiming the stimulus funds or the child tax credit. The IRS has advised taxpayers to double-check tax returns and make sure they declare every stimulus payment properly.