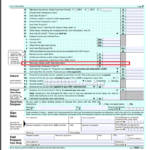

1040 Instructions 2023 Recovery Rebate Credit – The Recovery Rebate allows taxpayers to receive a tax refund without having to modify the tax return. This program is administered by the IRS and is a no-cost service. It is, however, crucial to understand the regulations and rules for the program prior to filing. Here are some information regarding this program.

Refunds from Recovery Rebate do not have to be adjusted

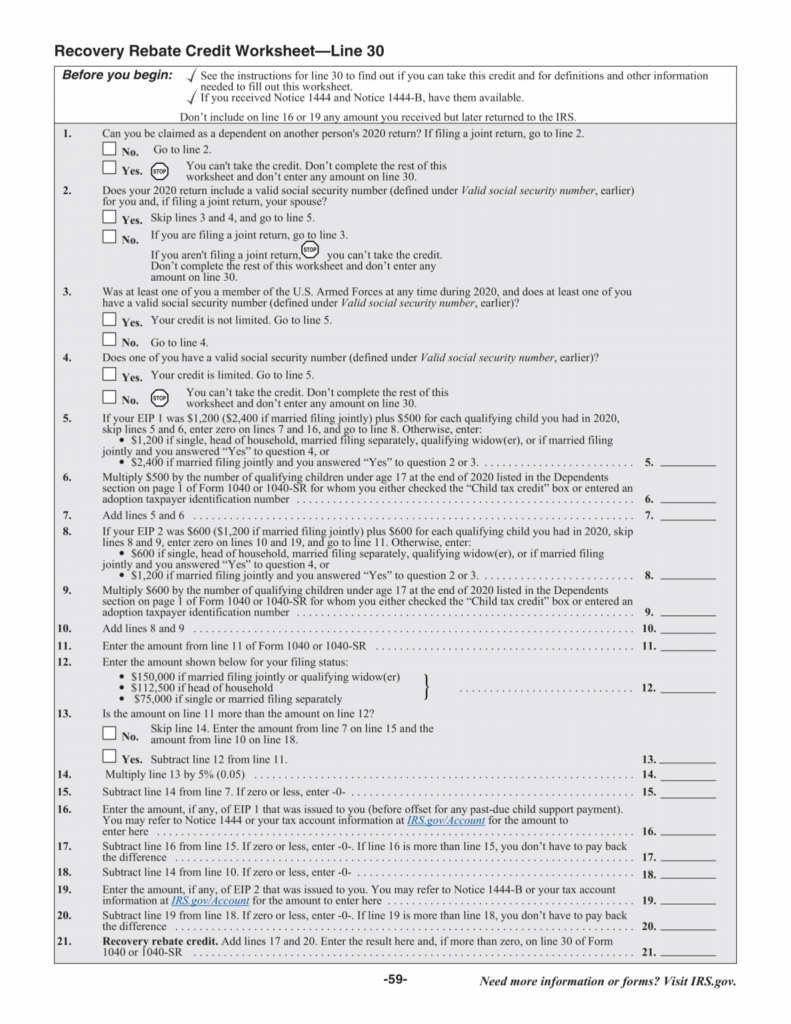

Recovery Rebate credits are paid to eligible taxpayers in advance. This means that your refund won’t be affected if you owe any more tax in 2020 compared to the year prior. In accordance with your earnings however the recovery credit could be cut. Your credit score will drop to zero if the income exceeds $75,000. Joint filers who file jointly with a spouse will notice their credit starting to decline to $150,000. Heads of household will begin to see their recovery rebate reimbursements decrease to $112,500.

Even though they didn’t receive the full stimulus payment individuals can still receive recovery rebate credits for their tax obligations in 2020. You’ll need an IRS account on the internet and an official notice in writing stating the total amount they received.

It does not offer a tax refund

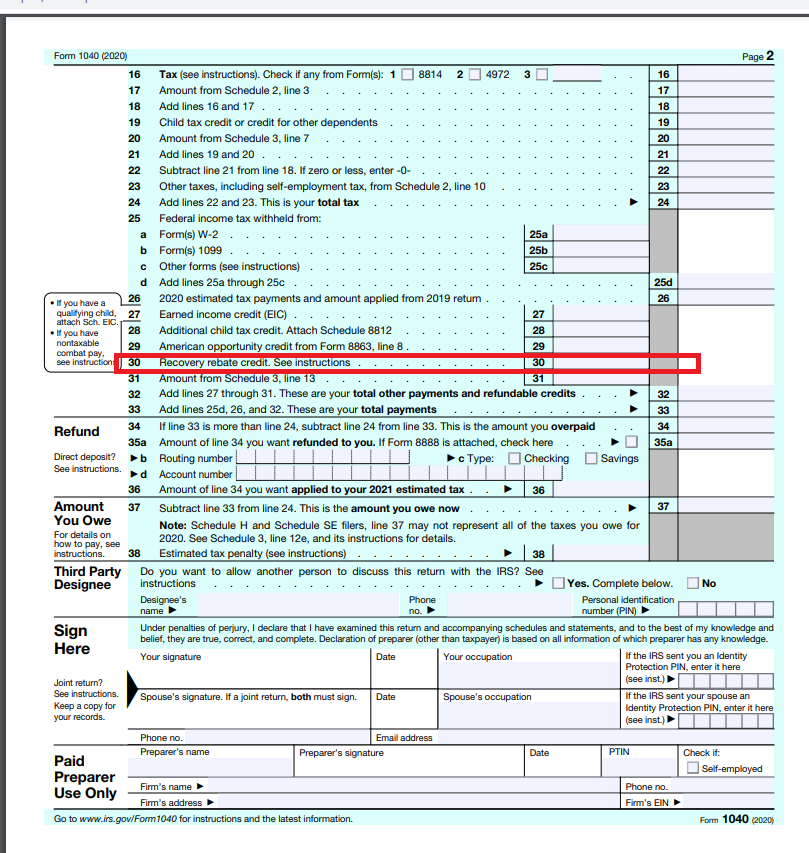

Although the Recovery Rebate doesn’t provide you with a tax return , it does provide you a tax credit. IRS has warned about potential mistakes when claiming this stimulus cash. The child tax credit is another area that has been subject to errors. The IRS will send a letter to you if the credit was not properly applied.

The Recovery Rebate can be applied to federal income tax returns from now to 2021. Each tax dependent can be qualified to receive as much as $1400 (married couples with 2 children) or up to $4200 (single taxpayers).

It may be delayed because of mistakes in math or calculations

If you receive a notice telling you that the IRS has found a math error in you tax return, it is recommended that you spend a few moments to check and correct your tax return information. If you do not provide accurate details, your refund could be delayed. The IRS provides extensive FAQs that can answer your questions.

There are several reasons why your recovery refund could be delayed. Most likely is that you have committed a mistake in claiming the stimulus money or child tax credit. The IRS is advising taxpayers to check their tax returns and be sure they’re claiming each stimulus payment.